![LYRICS: Jason Clayborn & The Atmosphere Changers – You're All I Need [ft. Hezekiah Walker] - Adonai Wap LYRICS: Jason Clayborn & The Atmosphere Changers – You're All I Need [ft. Hezekiah Walker] - Adonai Wap](https://www.adonaiwap.com/wp-content/uploads/2022/02/Deitrick-Haddon-150x150.jpg)

LYRICS: Jason Clayborn & The Atmosphere Changers – You're All I Need [ft. Hezekiah Walker] - Adonai Wap

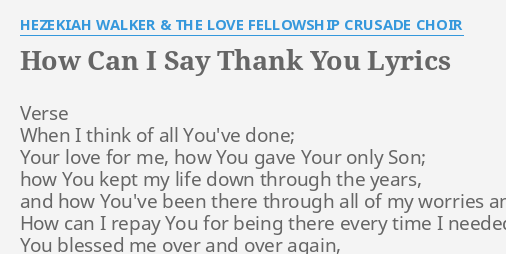

HOW CAN I SAY THANK YOU" LYRICS by HEZEKIAH WALKER & THE LOVE FELLOWSHIP CRUSADE CHOIR: Verse When I think...

![MP3 DOWNLOAD: You're All I Need - Jason Clayborn & The Atmosphere Changers Ft. Hezekiah Walker [+ Lyrics] MP3 DOWNLOAD: You're All I Need - Jason Clayborn & The Atmosphere Changers Ft. Hezekiah Walker [+ Lyrics]](https://www.justgospel.com.ng/wp-content/uploads/2021/05/Jason-Clayborn-1400x700-1.jpg)

MP3 DOWNLOAD: You're All I Need - Jason Clayborn & The Atmosphere Changers Ft. Hezekiah Walker [+ Lyrics]

Jason Clayborn & The Atmosphere Changers - You're All I Need (feat. Hezekiah Walker) (Remix): listen with lyrics | Deezer

![You're All I Need [Music Download]: Hezekiah Walker - Christianbook.com You're All I Need [Music Download]: Hezekiah Walker - Christianbook.com](https://g.christianbook.com/dg/product/cbd/f400/DL147872-CP.jpg)