Corsair Carbide SPEC-06 RGB Review | RGB VS Non-RGB + Water Cooling Support | Cases & Cooling | OC3D Review

Corsair Carbide SPEC-06 RGB Review | RGB VS Non-RGB + Water Cooling Support | Cases & Cooling | OC3D Review

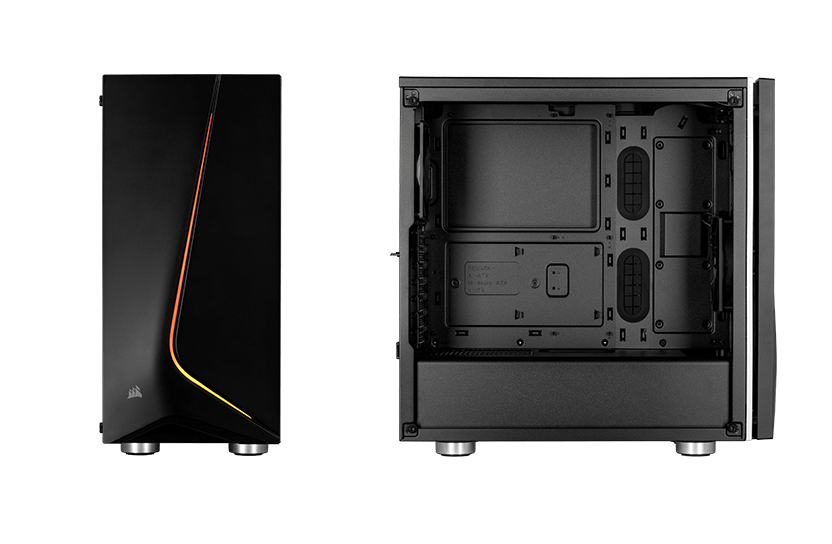

Corsair Spec-06 Tempered Glass RGB Midi tower PC casing Black, RGB 2 built-in fans, Built-in lighting, Window, Dust filt | Conrad.com

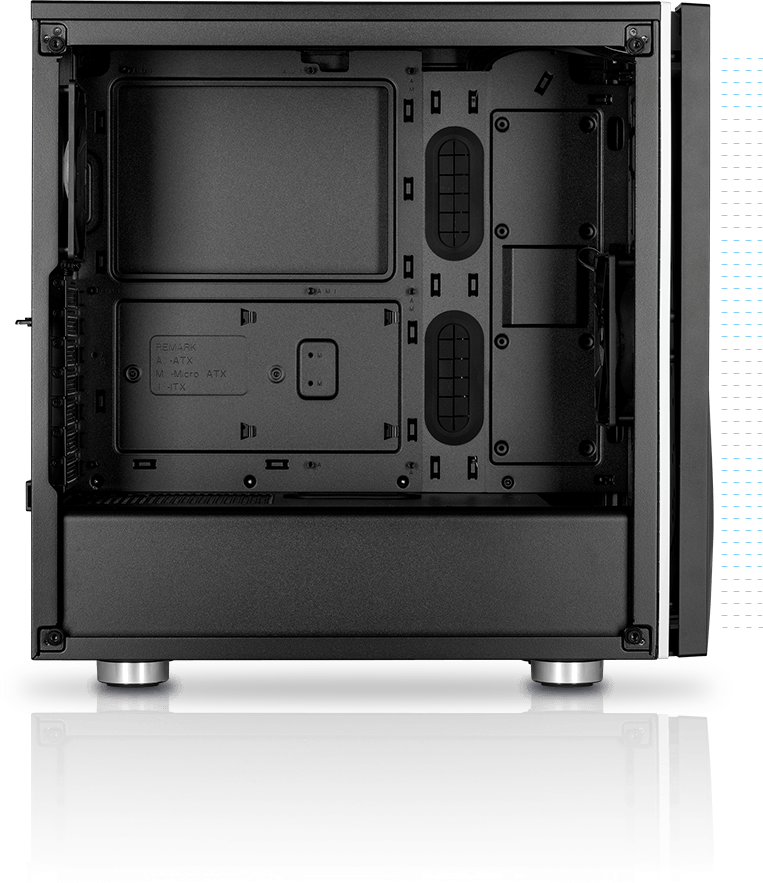

Corsair Spec-06 Tempered Glass RGB Midi tower PC casing White, RGB 2 built-in fans, Built-in lighting, Window, Dust filt | Conrad.com

Corsair Carbide SPEC-06 RGB Review | RGB VS Non-RGB + Water Cooling Support | Cases & Cooling | OC3D Review

.gif)

![The BEST Budget Case of 2018! [Corsair Spec-06 Review!] - YouTube The BEST Budget Case of 2018! [Corsair Spec-06 Review!] - YouTube](https://i.ytimg.com/vi/99ZCf_ClL_w/maxresdefault.jpg)

![Corsair Carbide SPEC-06 RGB, Tempered Glass Midi-Tower - white [GECS-115] from WatercoolingUK Corsair Carbide SPEC-06 RGB, Tempered Glass Midi-Tower - white [GECS-115] from WatercoolingUK](https://images.watercoolinguk.co.uk/images/product_images/large/61/corsair-carbide-spec-06-rgb-tempered-glass-midi-tower-white-gecs-115-71928-1.jpg)