Pumaspeed Fiesta Mk8 1.0l Quickshifter - Fiesta Mk8 1.0 - Transmission - Pumaspeed Milltek Ford Performance Tuning Milltek Sport Exhaust Ford Fiesta Focus ST RS Parts Specialist

Pumaspeed Focus Mk3 RS/ST250/STD Quickshift - Focus Mk3 ST (250PS) - Transmission - Pumaspeed Milltek Ford Performance Tuning Milltek Sport Exhaust Ford Fiesta Focus ST RS Parts Specialist

-2540-p.jpg)

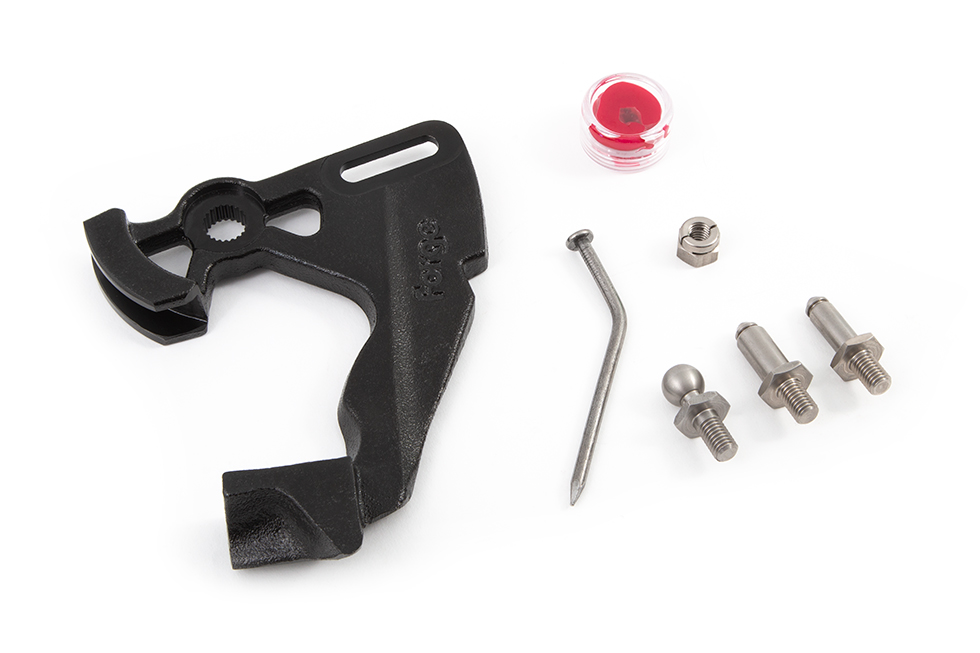

![Short-Shift Arm [Mk8 Fiesta ST | Puma ST] - mountune Short-Shift Arm [Mk8 Fiesta ST | Puma ST] - mountune](https://cdn.shopify.com/s/files/1/0367/2621/products/2709-SSA-1_2048x_3bd44b96-c577-4830-826b-f9111270707a_2048x.png?v=1619120700)