Fantastic Facts About The Proxy That Everybody Should Check Out Before Using Any Proxy! – Hosting Advices

How to Find Proxy Servers with PHP to Send a Request to Another Server - Tor PHP Get Proxy List package blog - PHP Classes

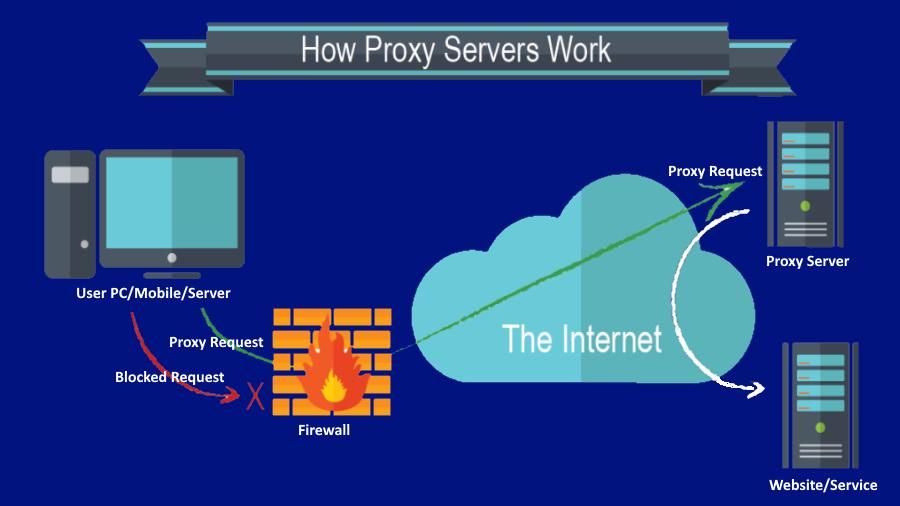

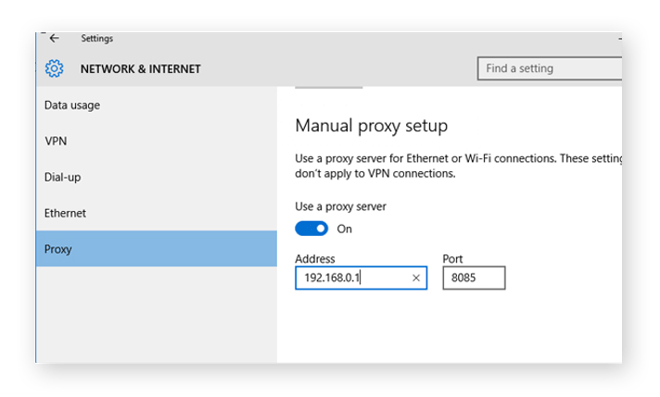

Proxy Server Addresses - How to Get Proxy Server Addresses to Hide Your IP, Access Blocked Websites, Speed up Sufring etc

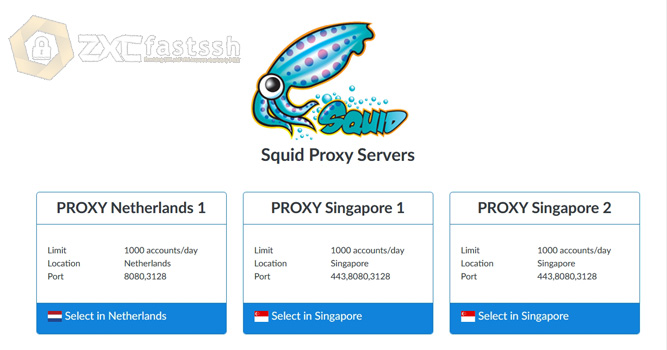

Proxy Server meaning and its Definitions, with amazing top 10 free Proxy server list - Data Privacy Acts

![How To Individually Change Proxy Server For Different Internet Browser & How To Get Free Proxy [Video] at ABC Trick | Proxy server, Proxies, New ip How To Individually Change Proxy Server For Different Internet Browser & How To Get Free Proxy [Video] at ABC Trick | Proxy server, Proxies, New ip](https://i.pinimg.com/736x/1e/38/dd/1e38dd29946e149af102f67f70538a2f--proxy-server-cracker.jpg)