Styropor Dämmplatten EPS DEO 035 dm - 100 kPa *sicherer Versand Ihrer Bestellung durch passgenaue 2-wellige Versandkartons* : Amazon.de: Beauty

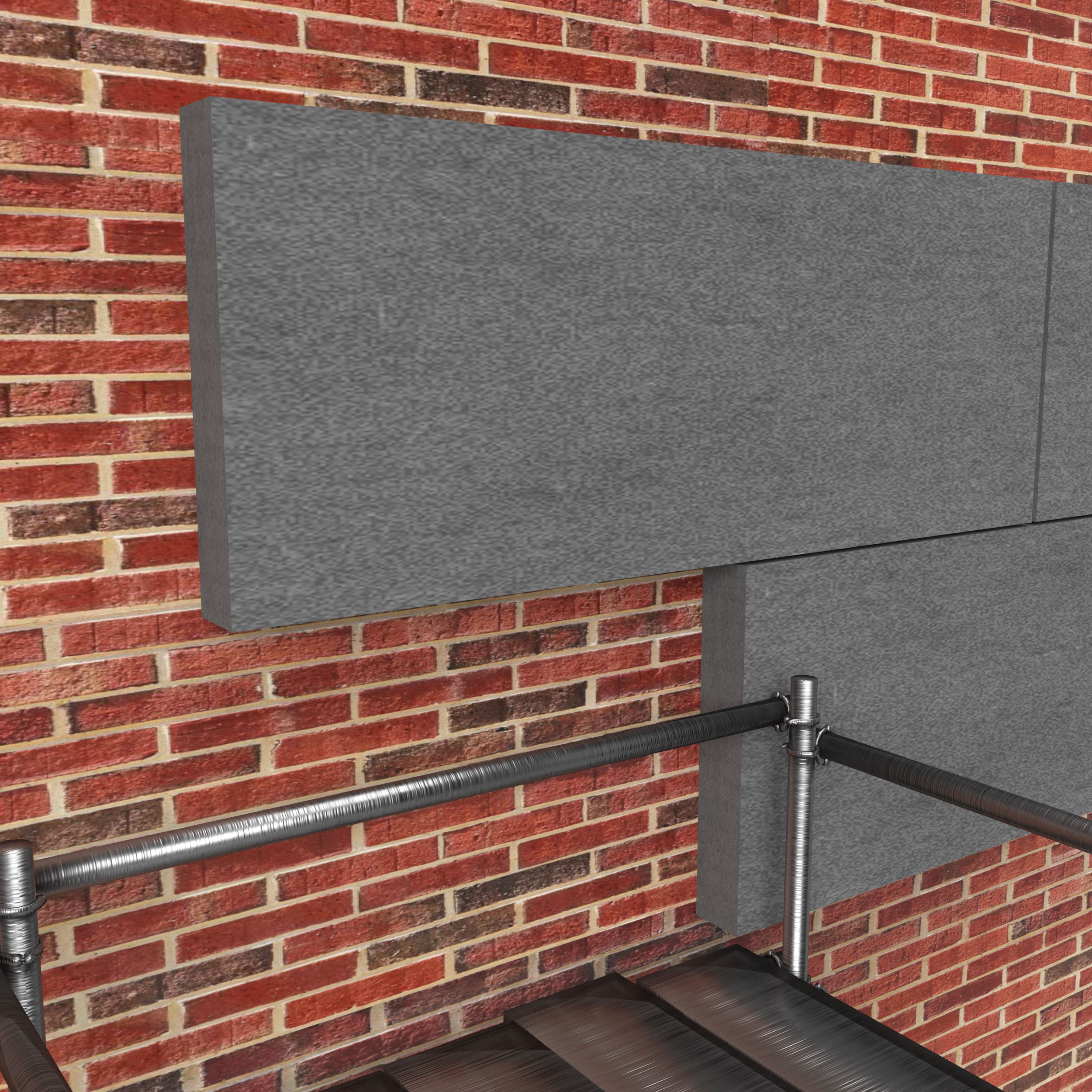

10 EPS-Platten mit Graphit aus Styropor + Gipskarton, 100 x 120 x 3 cm, Wärmedämmung und Schalldämmung für den Innenbereich. : Amazon.de: Baumarkt

Styroporplatten, EPS70, SDN, Polystyrol-Hartschaum, klein, starr, weiß, 600 mm lang x 400 mm breit x 25 mm dick, Isolierung, Verpackung usw., 5 Platten : Amazon.de: Baumarkt

10m² HD24 Fußbodenheizung Dämmplatten für Tackersystem, 20 DEO dm, 20mm - Heizung und Solar zu Discountpreisen

Styropor Dämmplatten EPS DEO 035 dm - 100 kPa *sicherer Versand Ihrer Bestellung durch passgenaue 2-wellige Versandkartons* : Amazon.de: Beauty