Black Orc Big Boss Warhammer Total War GIF - Black Orc Big Boss Warhammer Total War Greenskins - Discover & Share GIFs

Since the Black Orc Big Boss is confirmed, could this mean we get the Savage Orc Big Boss for the Skulls for the Skull Throne Event? : r/totalwar

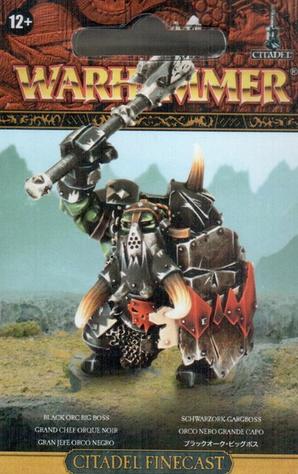

Big Boss, Black Orc, Orcs And Goblins, Warhammer Fantasy - First Eleven Black Orcs - Gallery - DakkaDakka | Roll the dice to see if I'm getting drunk.

Total War: Warhammer 2 beta update has greatly beefed up Orcs and the new Black Orc Big Boss hero - Gamesear