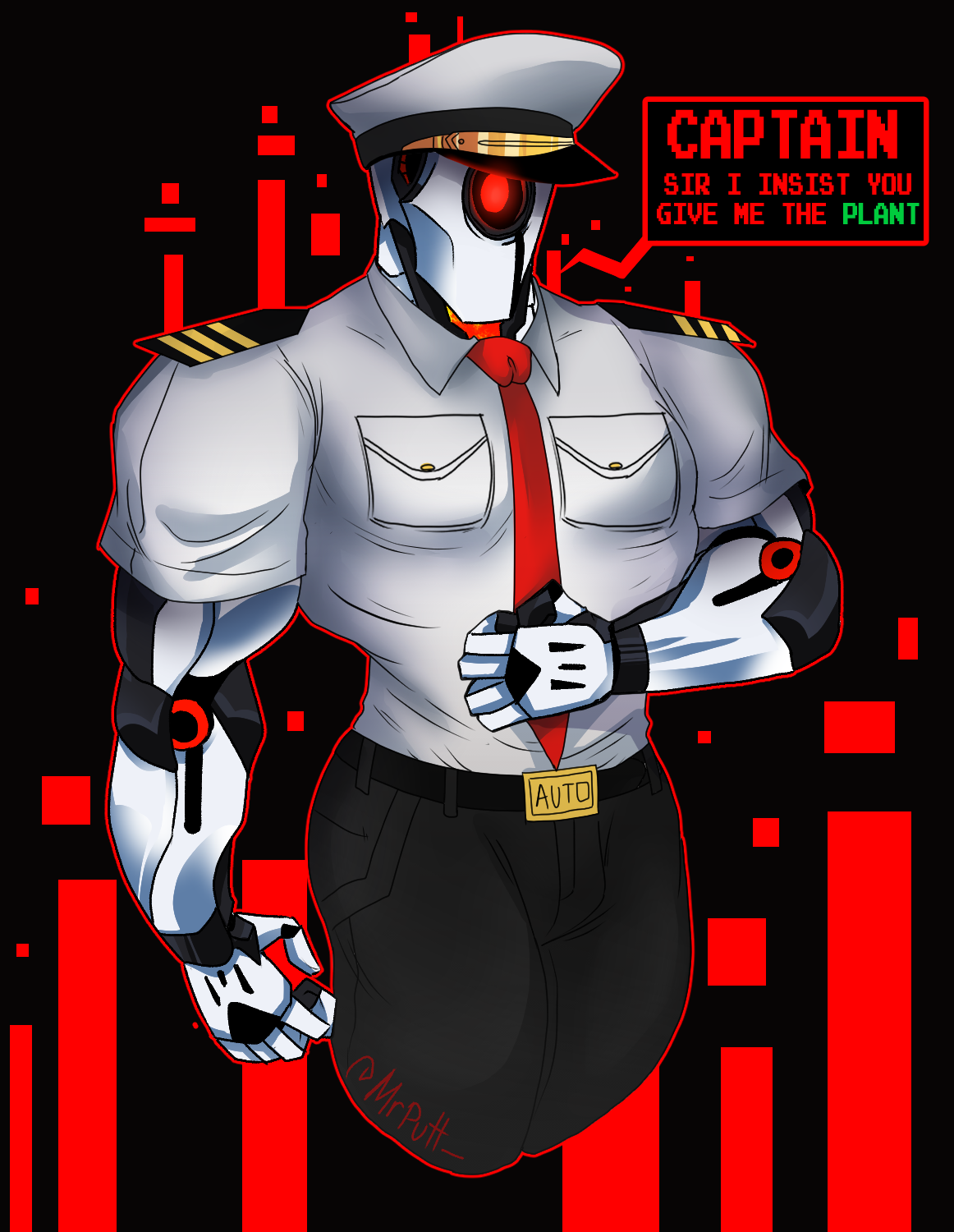

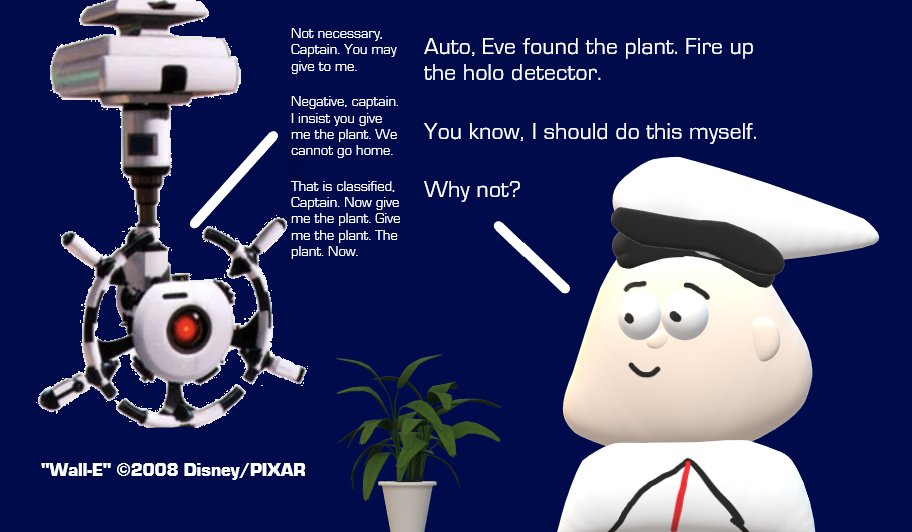

🦴MrPutt🦴 on Twitter: "He really wanted that plant. I liked how even though Auto was an antagonist, it was only b/c he was following orders. I really love Wall-e. Its one of

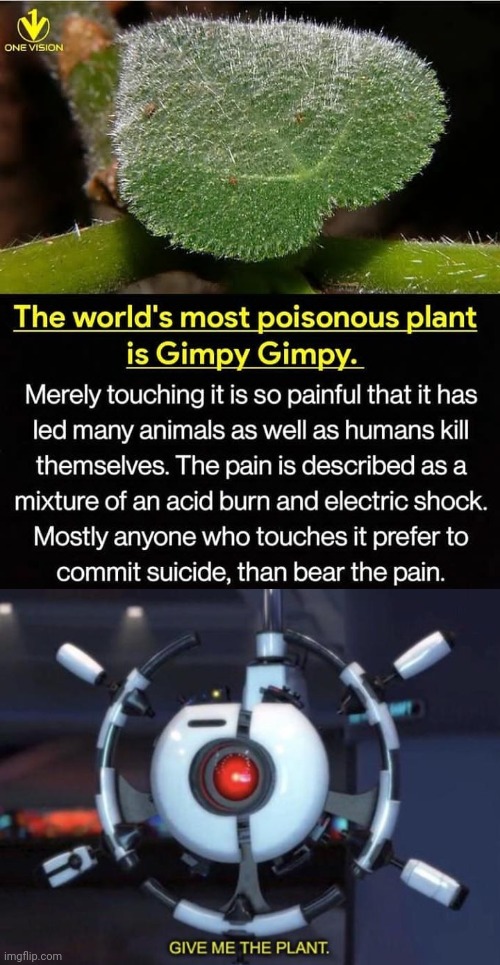

Ottoman Traders *Imports Tulips* 16th Century Dutch People GIVE ME THE PLANT TuLIps | History Meme on loveforquotes.com

![Give him the plant if you want to live | •Countryhumans Amino• [ENG] Amino Give him the plant if you want to live | •Countryhumans Amino• [ENG] Amino](http://pm1.narvii.com/7303/3b3d3195cac61c5fd32010ce02c5e5933187c254r1-612-768v2_uhq.jpg)