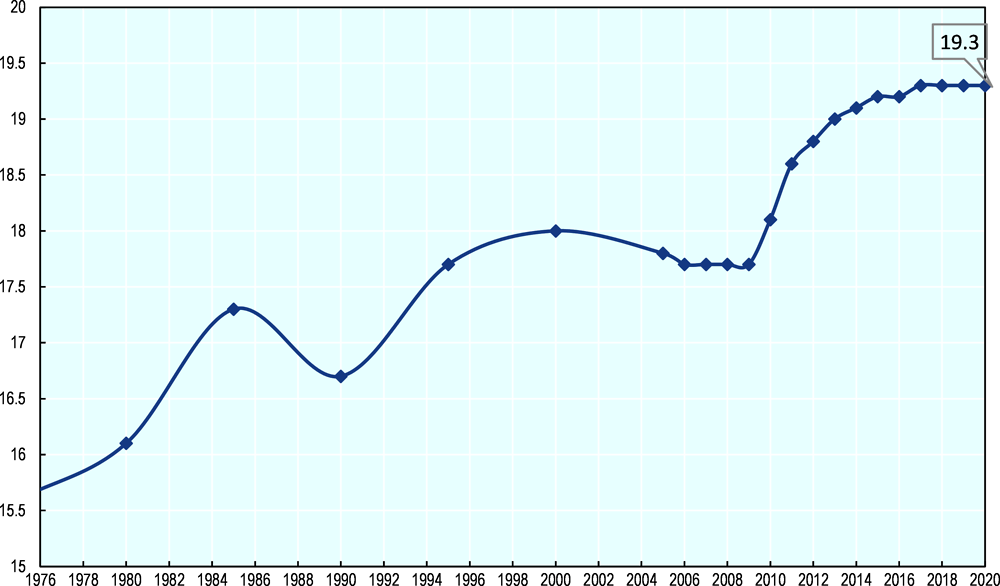

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

The Revenue Administration-Gap Analysis Program in: Technical Notes and Manuals Volume 2017 Issue 004 (2017)

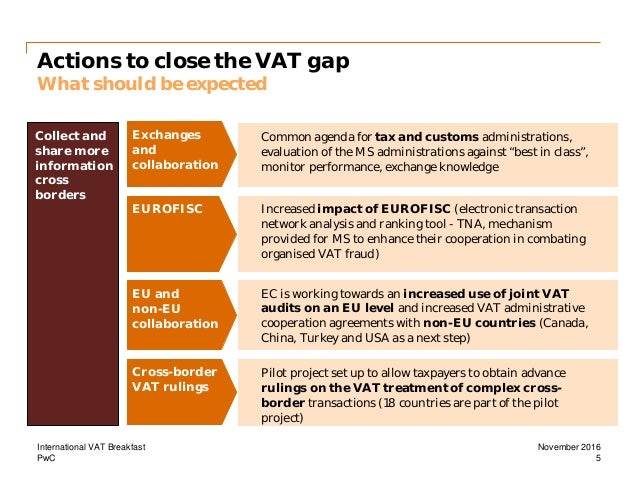

Eugen Jurzyca on Twitter: "Before further #harmonisation of VAT rules it would be worth analysing the effectiveness of national antifraud VAT measures and exchange of best practices to know why some Member

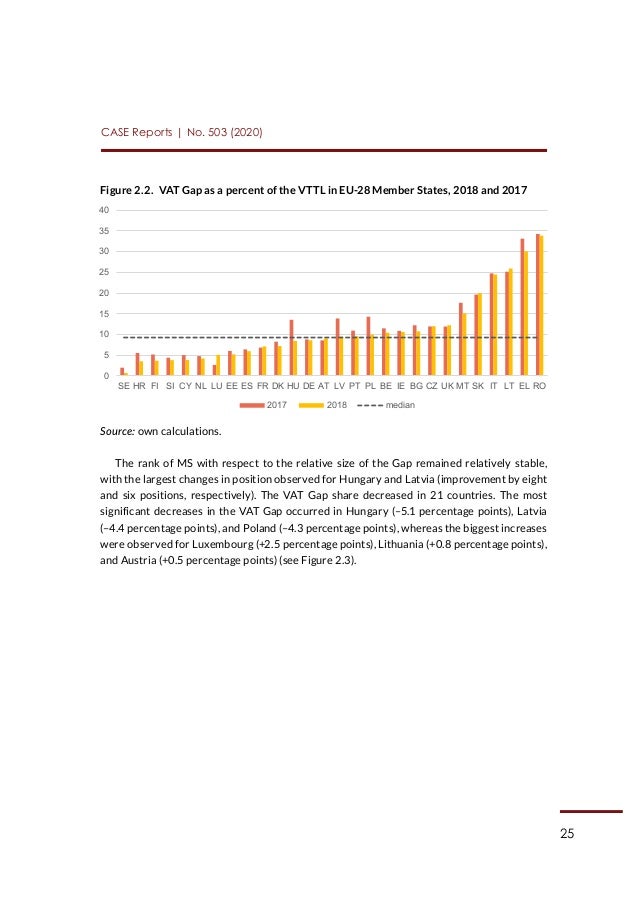

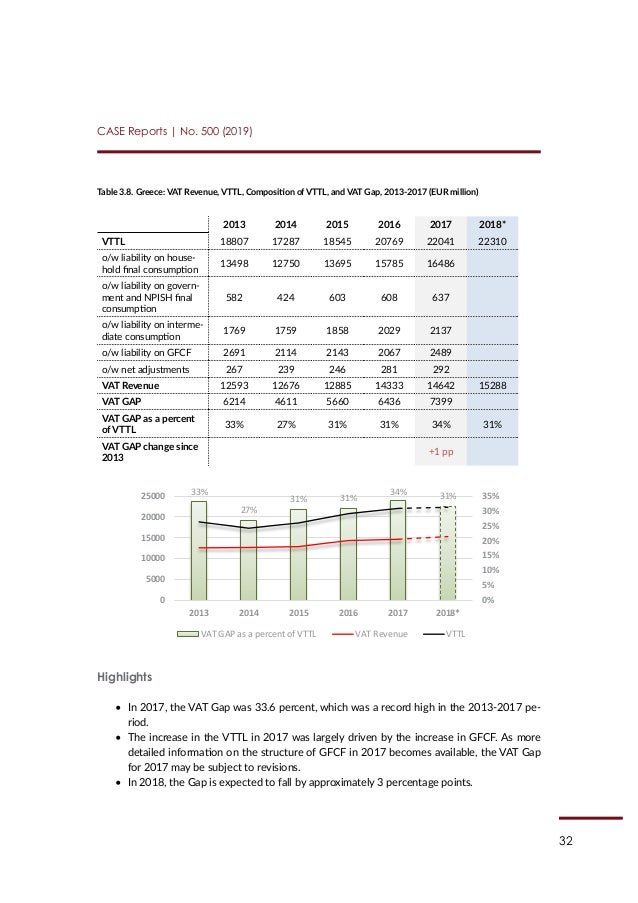

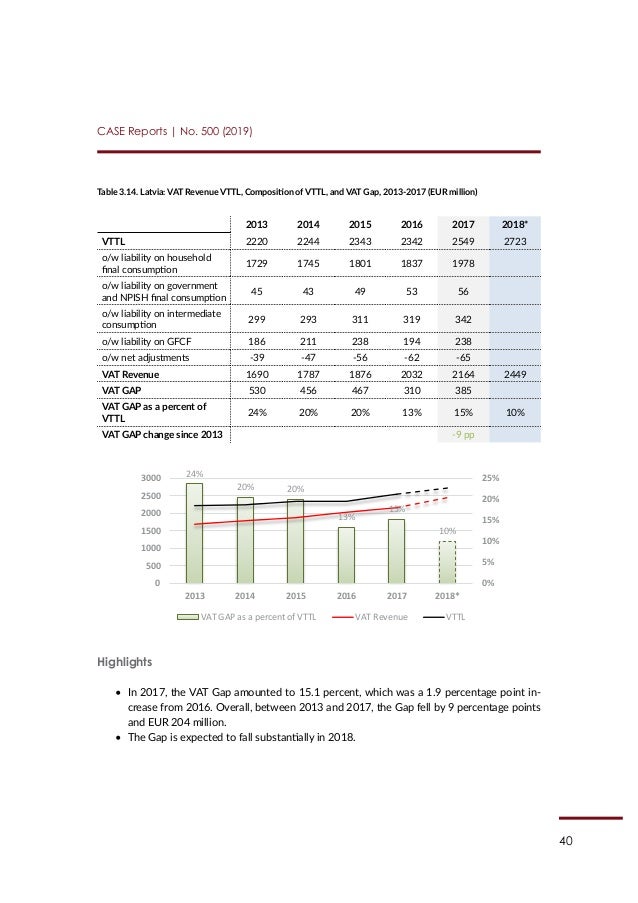

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

Conference on VAT frauds in EU Member States and the competence of the EU Institutions Fiscal A Hungarian Perspective Brussels, 4 February, 2015 | Balázs. - ppt download

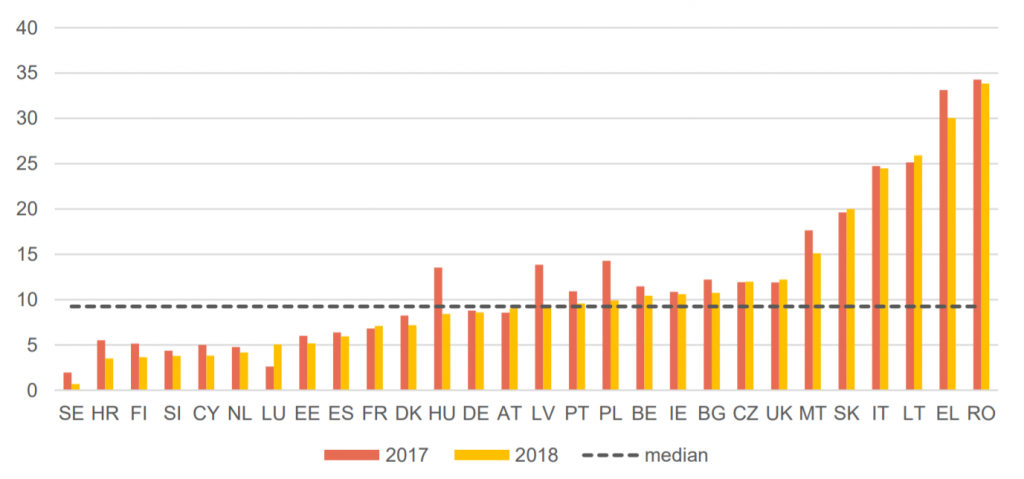

EU Tax & Customs 🇪🇺 on Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "