Mailman of the Deutsche Post AG, German post, on a bike in Regensburg, Bavaria, Germany, Europe, Stock Photo, Picture And Rights Managed Image. Pic. IBR-962375 | agefotostock

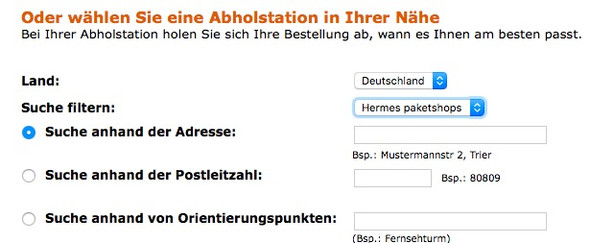

Hermes-Paketshop muss sonntags schließen / DHL-Paketzentrum in Österreich steht leer / Neuigkeiten zum Chinaporto

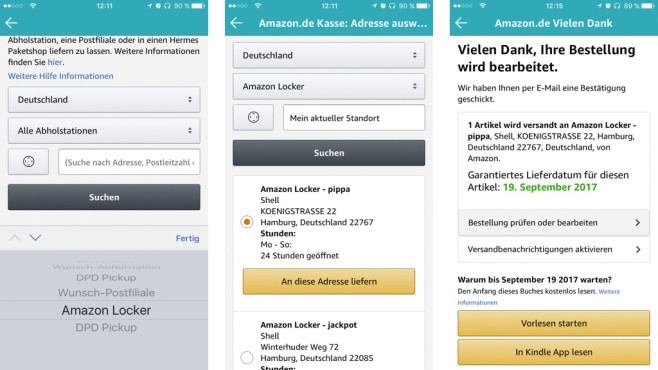

Amazon HD 10 fire Tablet WLAN 7. Generation in Baden-Württemberg - Leinfelden-Echterdingen | eBay Kleinanzeigen