Sword Art Online: Fairy Dance, Vol. 1 - manga (Sword Art Online Manga, 2): Kawahara, Reki, Haduki, Tsubasa: 9780316407380: Amazon.com: Books

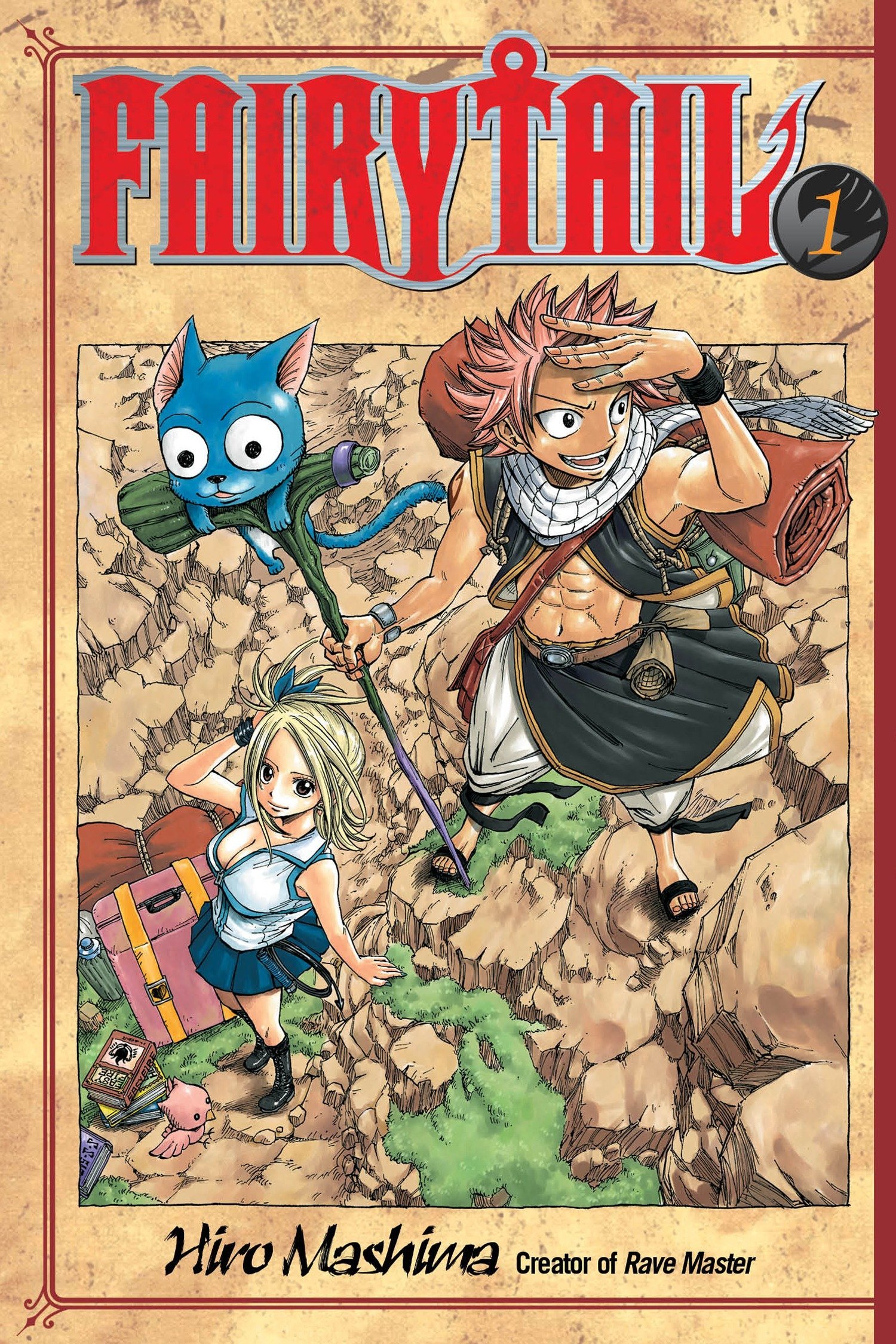

FAIRY TAIL Master's Edition Vol. 2 (Fary Tail Master's Edition) Traditional Japanese Manga: Mashima, Hiro: 9781632362773: Amazon.com: Books