Don't Pay $99, Get the LEGO Architecture London Skyline Collection for $31.99 Shipped – This Weekend Only – TechEBlog

London Skyline: set review and LEGO® Designer interview | New Elementary: LEGO® parts, sets and techniques

Got this LEGO architecture set of London skyline for Christmas from the wifey and it was such fun building it. : r/lego

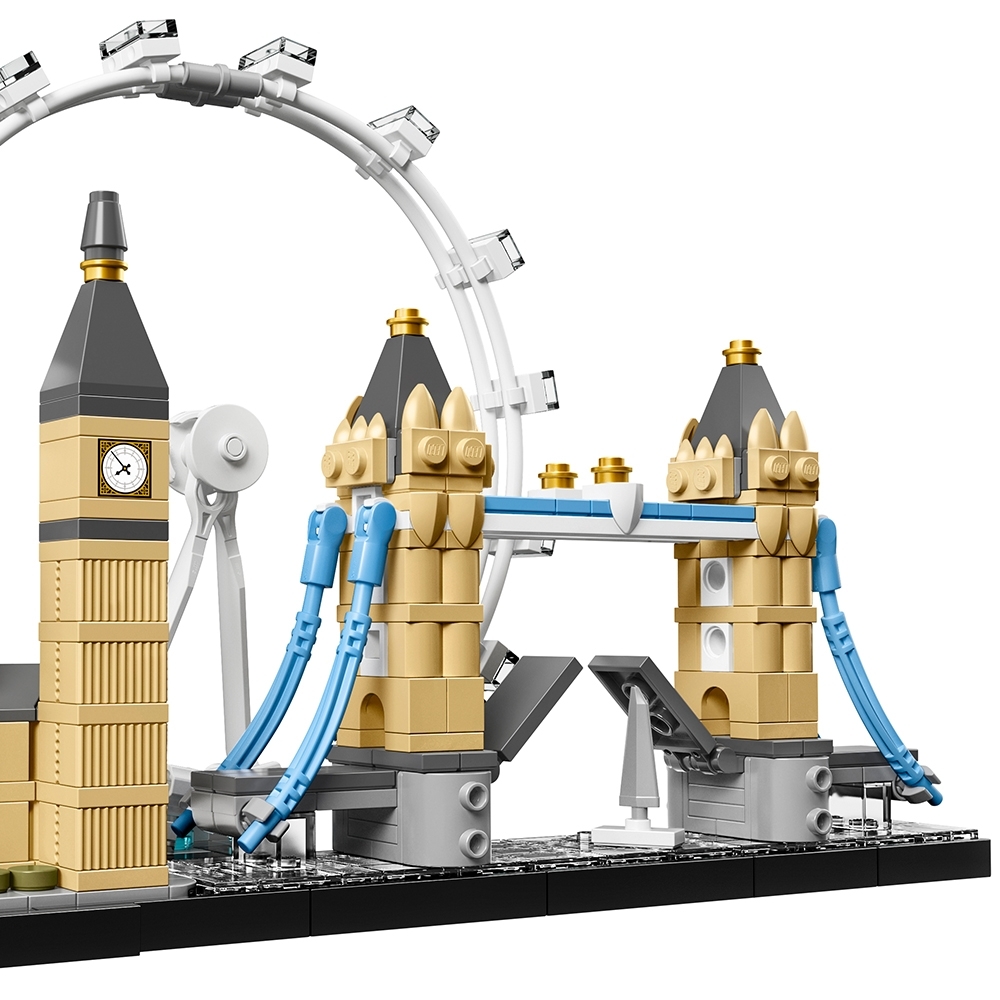

![LEGO Architecture 21034 London city skyline [Review] - The Brothers Brick | The Brothers Brick LEGO Architecture 21034 London city skyline [Review] - The Brothers Brick | The Brothers Brick](https://s3-us-west-2.amazonaws.com/media.brothers-brick.com/wp-content/uploads/2018/12/25382491729_97b5abef08_k.jpg)

![LEGO Architecture 21034 London city skyline [Review] - The Brothers Brick | The Brothers Brick LEGO Architecture 21034 London city skyline [Review] - The Brothers Brick | The Brothers Brick](https://s3-us-west-2.amazonaws.com/media.brothers-brick.com/wp-content/uploads/2018/12/30716822810_414d9f17a0_z.jpg)

![LEGO Architecture 21034 London city skyline [Review] - The Brothers Brick | The Brothers Brick LEGO Architecture 21034 London city skyline [Review] - The Brothers Brick | The Brothers Brick](https://s3-us-west-2.amazonaws.com/media.brothers-brick.com/wp-content/uploads/2018/12/25382492069_b80d206215_k.jpg)