Amazon.com: Life As We Know It - The Complete Series : Michael Engler, Sean Faris, Missy Peregrym, Jessica Lucas, Kelly Osbourne: Movies & TV

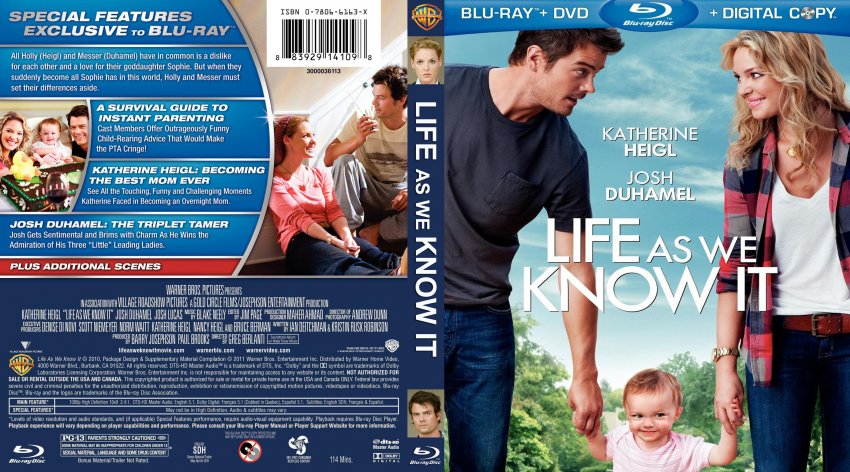

Life As We Know It - Movie Blu-Ray Custom Covers - Life As We Know It 2010 - English - Custom - Bluray f :: DVD Covers

![Amazon.com: Life As We Know It [DVD] [2010] : Movies & TV Amazon.com: Life As We Know It [DVD] [2010] : Movies & TV](https://m.media-amazon.com/images/I/91MkB5AslRL._SL1500_.jpg)

![Life as We Know It [2 Discs] [Blu-ray/DVD] [2010] - Best Buy Life as We Know It [2 Discs] [Blu-ray/DVD] [2010] - Best Buy](https://pisces.bbystatic.com/image2/BestBuy_US/exc/videometadata/thumbnail/bb36bde965222331380cbc060d130b65.jpg)

![Life As We Know It [DVD] [2010] - Best Buy Life As We Know It [DVD] [2010] - Best Buy](https://pisces.bbystatic.com/image2/BestBuy_US/images/products/1895/1895324_so.jpg)