Amazon Basics DisplayPort auf HDMI Kabel mit vergoldeten Steckern 1,8 m: Amazon.de: Elektronik & Foto

Amazon Basics Hochgeschwindigkeits-HDMI-Kabel, Typ Micro-HDMI auf HDMI, HDMI-Standard 2.0 - 0,91 meter: Amazon.de: Elektronik & Foto

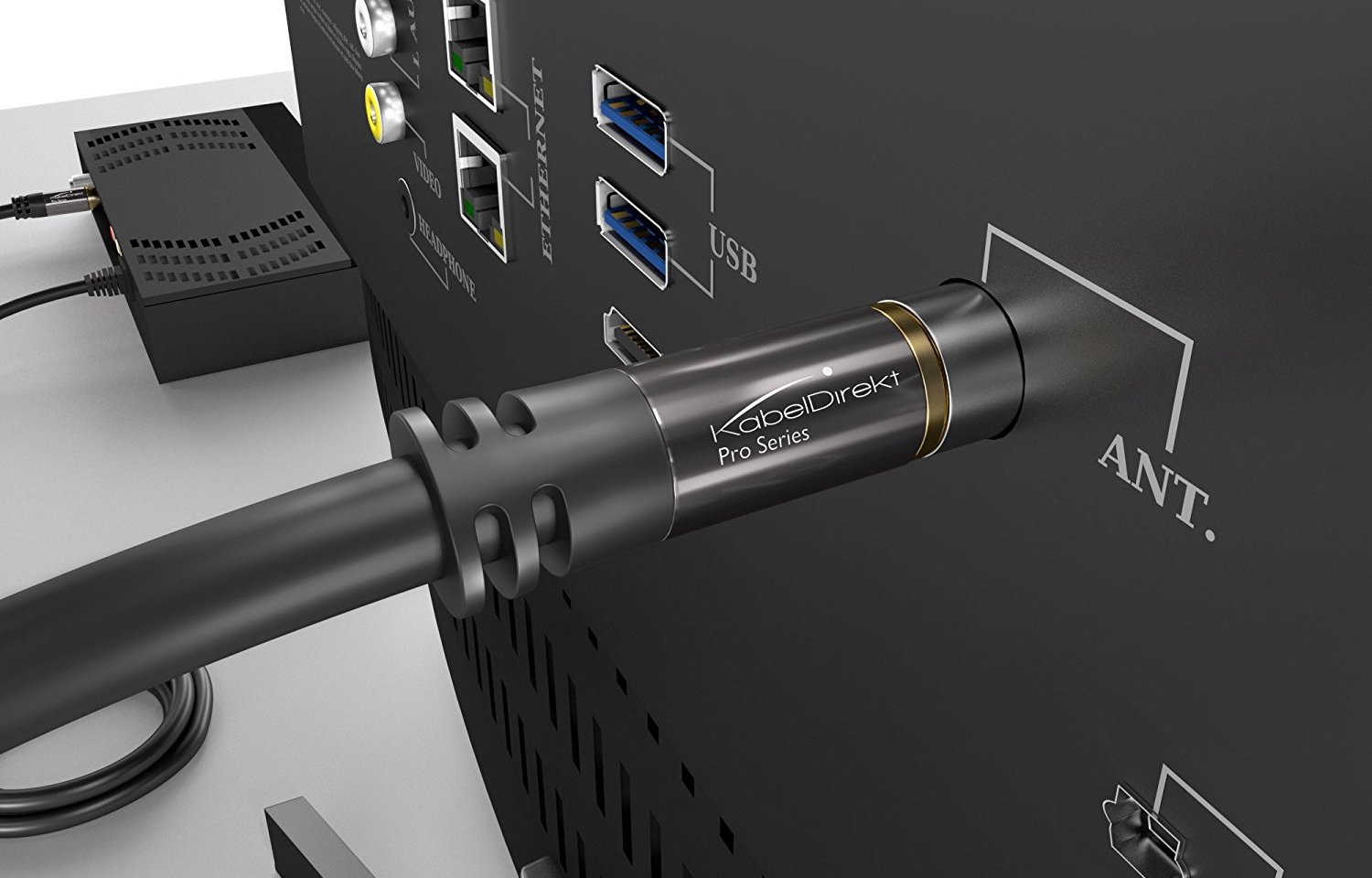

HB-DIGITAL 100m Koaxialkabel HQ-135 Antennenkabel 135dB SAT Kabel 8K 4K UHD 4-Fach geschirmt für DVB-S / S2 DVB-C / C2 DVB-T / T2 DAB+ Radio BK Anlagen + 10 F-Stecker GRATIS: Amazon.de:

USB Kabel Anschlusskabel für Drucker Druckerkabel für Drucker USB-A auf USB-...: Amazon.de: Elektronik & Foto

Axing TVS 8-01 Breitbandverstärker mit 2 Ausgängen für DTT und FM oder TV- Kabel: Amazon.de: Elektronik & Foto

Firstcom® IEC-60320 C13 Netzkabel Stromkabel für Computer, Fernseher, Monitor, Drucker Kaltgerätekabel Schuko Stecker 90° Abgewinkelt: Amazon.de: Elektronik & Foto

Donau Elektronik GMBH Original Kabel Kupfer Litzen 10er Set & Amazon Basics USB 3.0-Verlängerungskabel A-Stecker auf A-Buchse, 2 m: Amazon.de: Computer & Zubehör

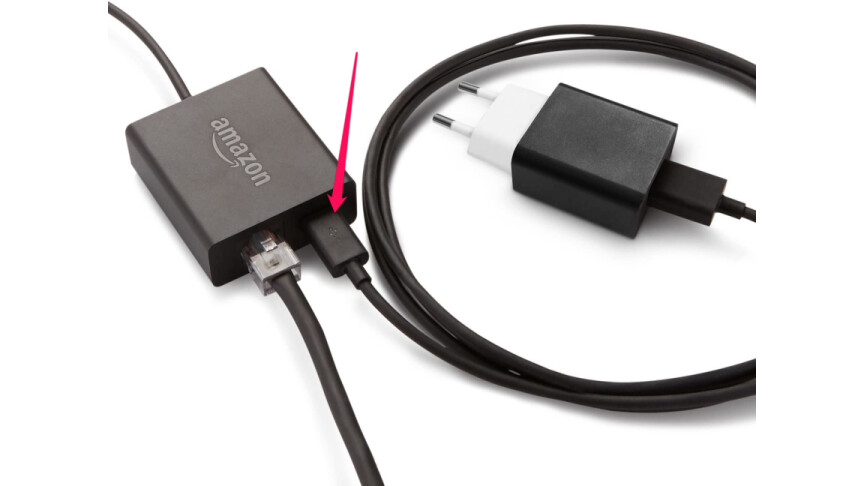

Mission USB Stromkabel - Ladekabel - Power Kabel für Amazon Fire TV (Keine separate Steckdose mehr notwendig) : Amazon.de: Elektronik & Foto

Amazon Netzteil für Amazon Echo Spot und Echo Dot (3. Gen.), Schwarz : Amazon.de: Computer & Zubehör