Suchergebnis auf Amazon.de für: Aldi - Wasserkocher / Wasserkocher & Heißwasserspender: Küche, Haushalt & Wohnen

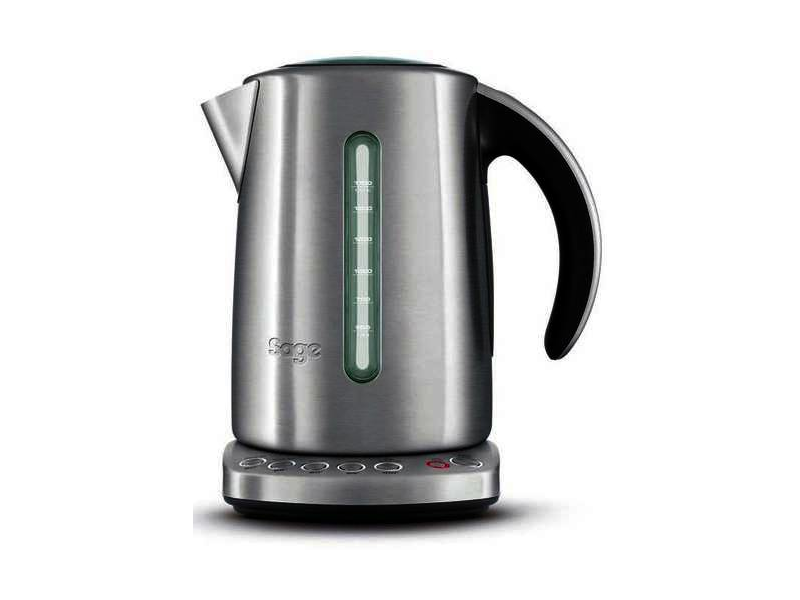

Sage Appliances SKE825 The Smart Kettle Wasserkocher 2400 W mit Warmhaltefunktion - Preise und Testberichte bei yopi.de

Suchergebnis auf Amazon.de für: Aldi - Wasserkocher / Wasserkocher & Heißwasserspender: Küche, Haushalt & Wohnen

TronicXL Retro Design Edelstahl Wasserkocher Wasserkessel elektrisch Vintage 1,8 Liter Soft-Touch mit Thermometer Wasser kocher Designer Wassererhitzer elektrischer Kessel weiß : Amazon.de: Küche, Haushalt & Wohnen

Amazon.de: KHAPP 15130009 - Retro - Premium Wasserkocher aus Edelstahl - Kabellos - 2025 Watt -1,20 Liter - Teekessel - (Light Blue)

Suchergebnis auf Amazon.de für: Aldi - Wasserkocher / Wasserkocher & Heißwasserspender: Küche, Haushalt & Wohnen

Suchergebnis auf Amazon.de für: wasserkocher retro - Wasserkocher / Wasserkocher & Heißwasserspender: Küche, Haushalt & Wohnen

Suchergebnis auf Amazon.de für: Aldi - Wasserkocher / Wasserkocher & Heißwasserspender: Küche, Haushalt & Wohnen

![Penny - Black Week 2019 Aktueller Prospekt 25.11 - 30.11.2019 [43] - jedewoche-rabatte.de Penny - Black Week 2019 Aktueller Prospekt 25.11 - 30.11.2019 [43] - jedewoche-rabatte.de](https://static.jedewoche-rabatte.de/image/item/penny/26045/img043.jpg)