Surface Electric field variation along the channel under the gates M1,... | Download Scientific Diagram

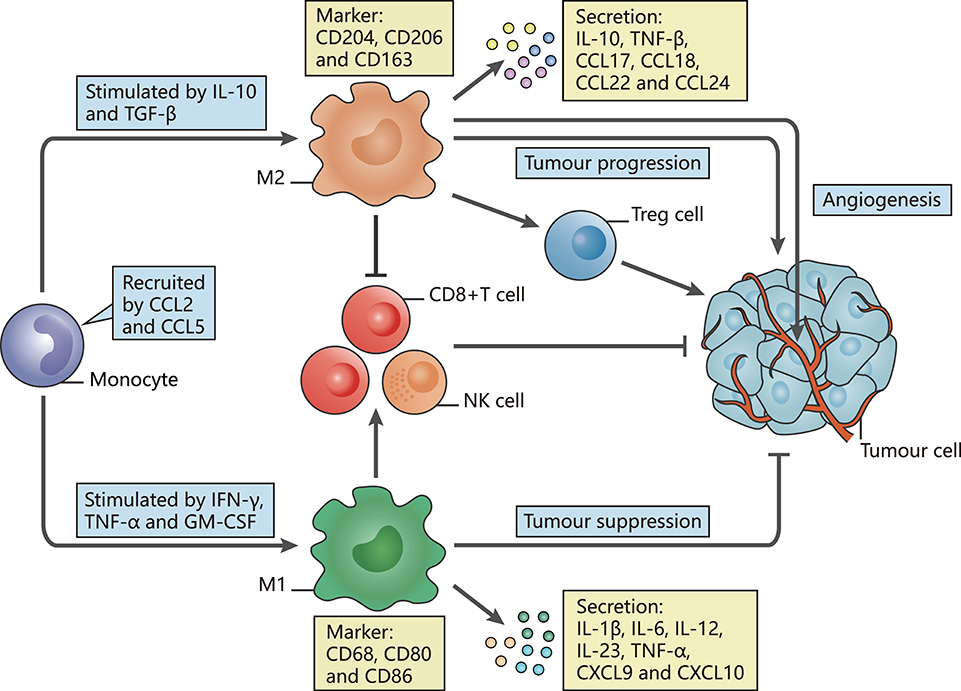

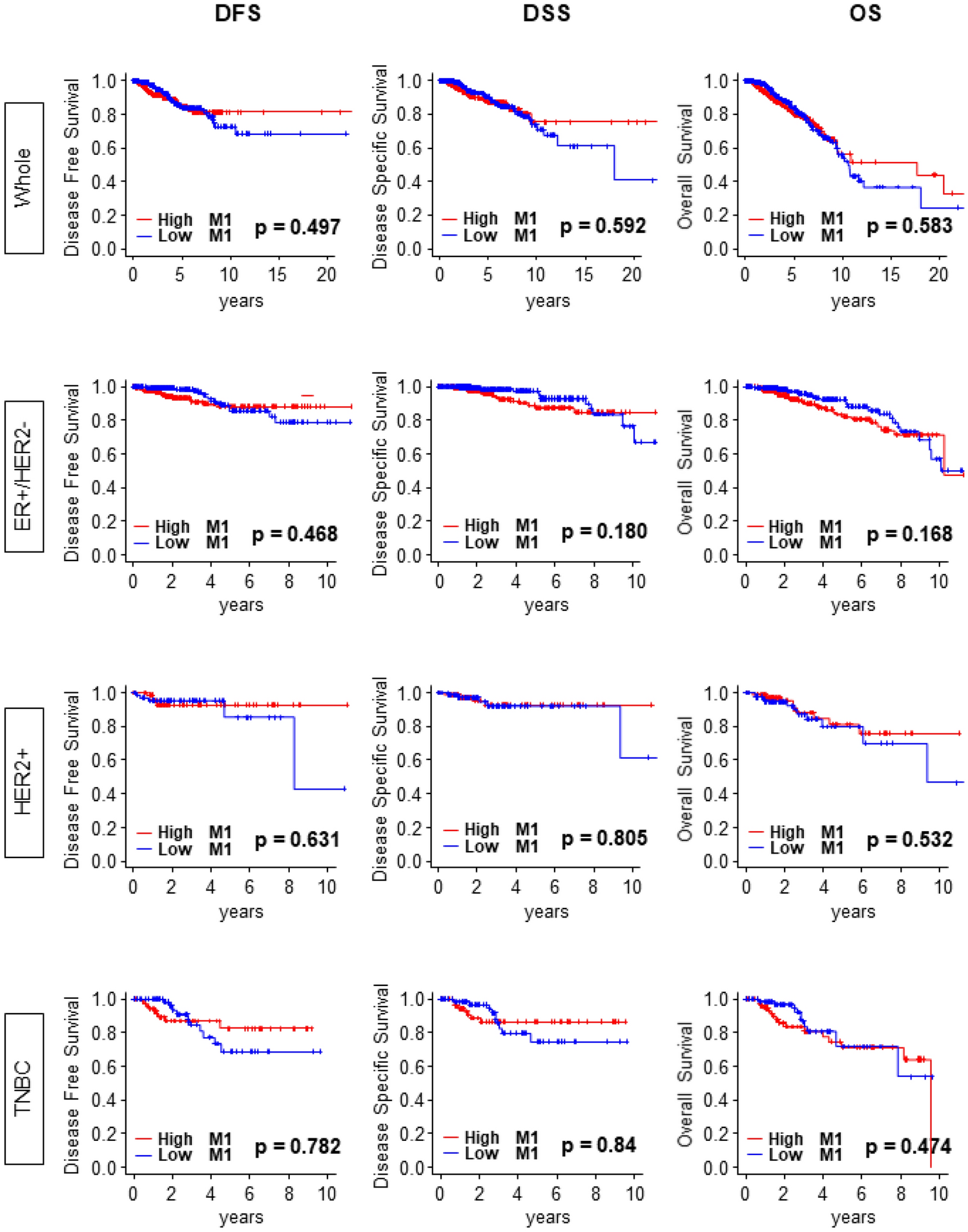

Frontiers | Redefining Tumor-Associated Macrophage Subpopulations and Functions in the Tumor Microenvironment | Immunology

TaylorMade Golf Company Unveils Re-Engineered M2 and Introduces All-New M1 Irons - TaylorMade Golf Canada (news)

Color online) (a) The zero-gap line in (M1, M2) plane for the case of... | Download Scientific Diagram

Functional Expression in Xenopus Oocytes of Gap-junctional Hemichannels Formed by a Cysteine-less Connexin 43* - Journal of Biological Chemistry

![PDF] REGULATION OF CONNEXIN 43 CHANNELS BY PKC-MEDIATED PHOSPHORYLATION. | Semantic Scholar PDF] REGULATION OF CONNEXIN 43 CHANNELS BY PKC-MEDIATED PHOSPHORYLATION. | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/4def1cb179c9e0028fa6d400053c69f41321ff92/4-Figure1-1.png)