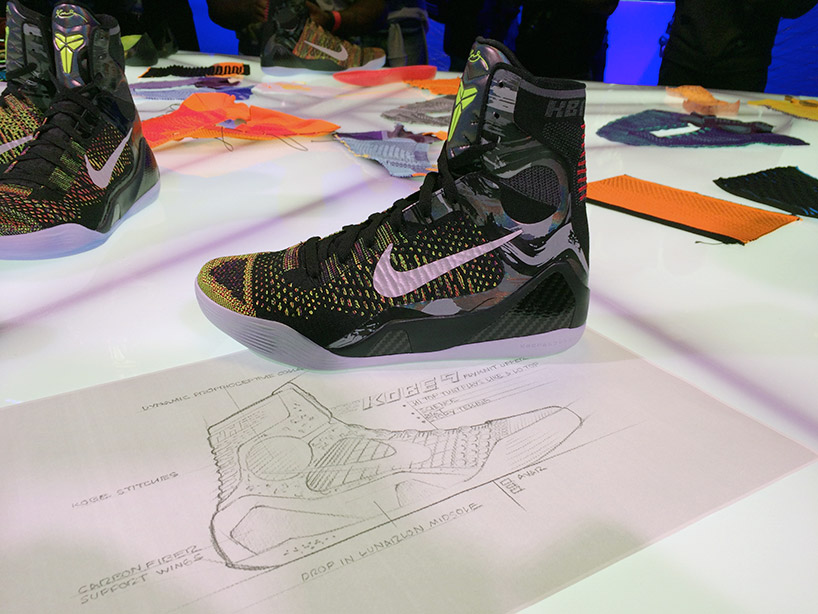

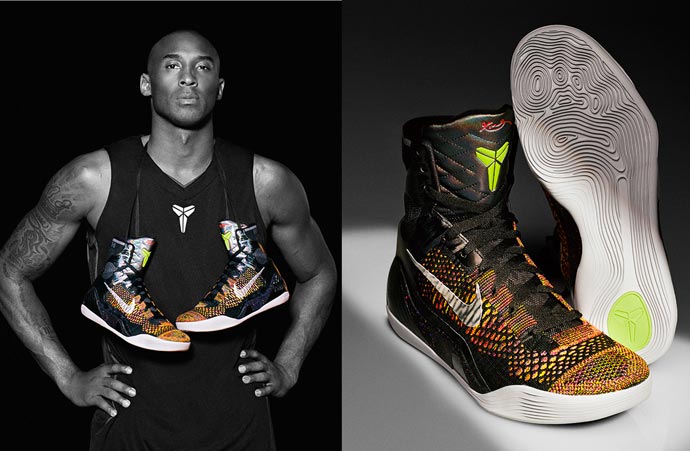

2016 Nike Kobe 9 ELITE Perspective Mens Hight Cut Basketball Shoes ,Wholesale Cheap Original Basketball Sneakers Shoes Nike Kobe Shoes From Greensky84, $102.7 | DHgate.Com

Nike Unveils The Kobe 9 Elite, $225 Hightop Socks | High top basketball shoes, Nike shoes cheap, New nike shoes