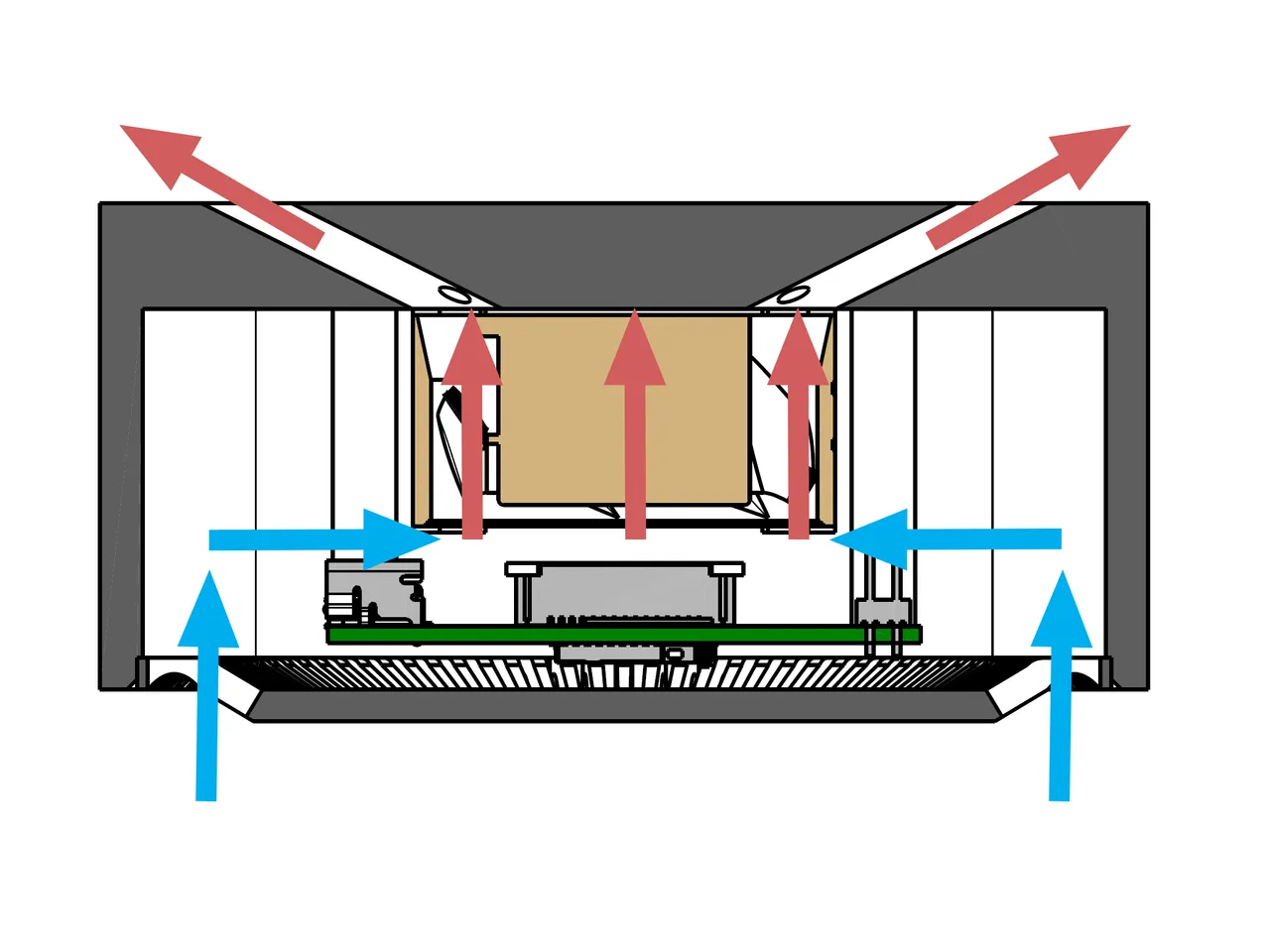

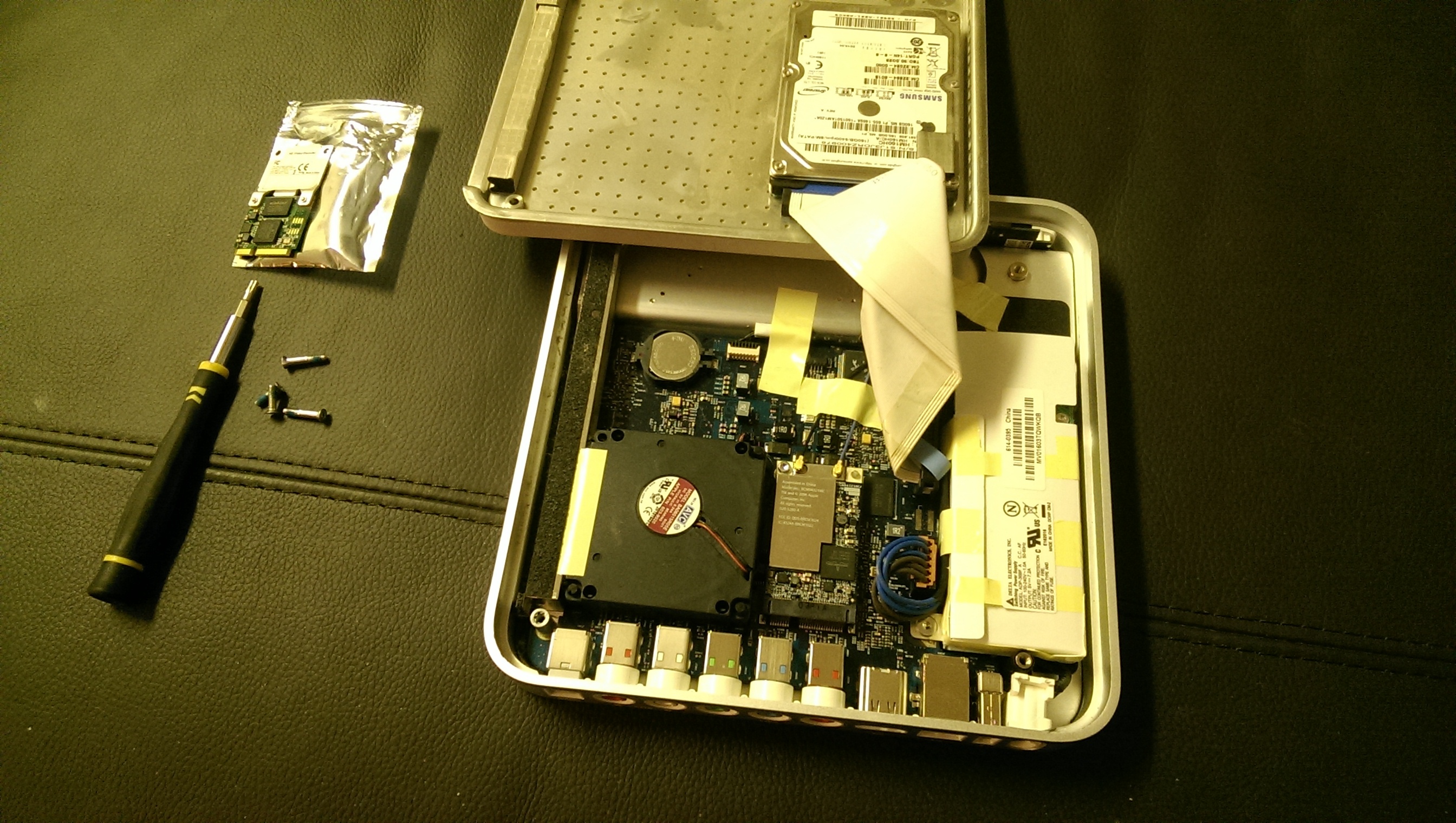

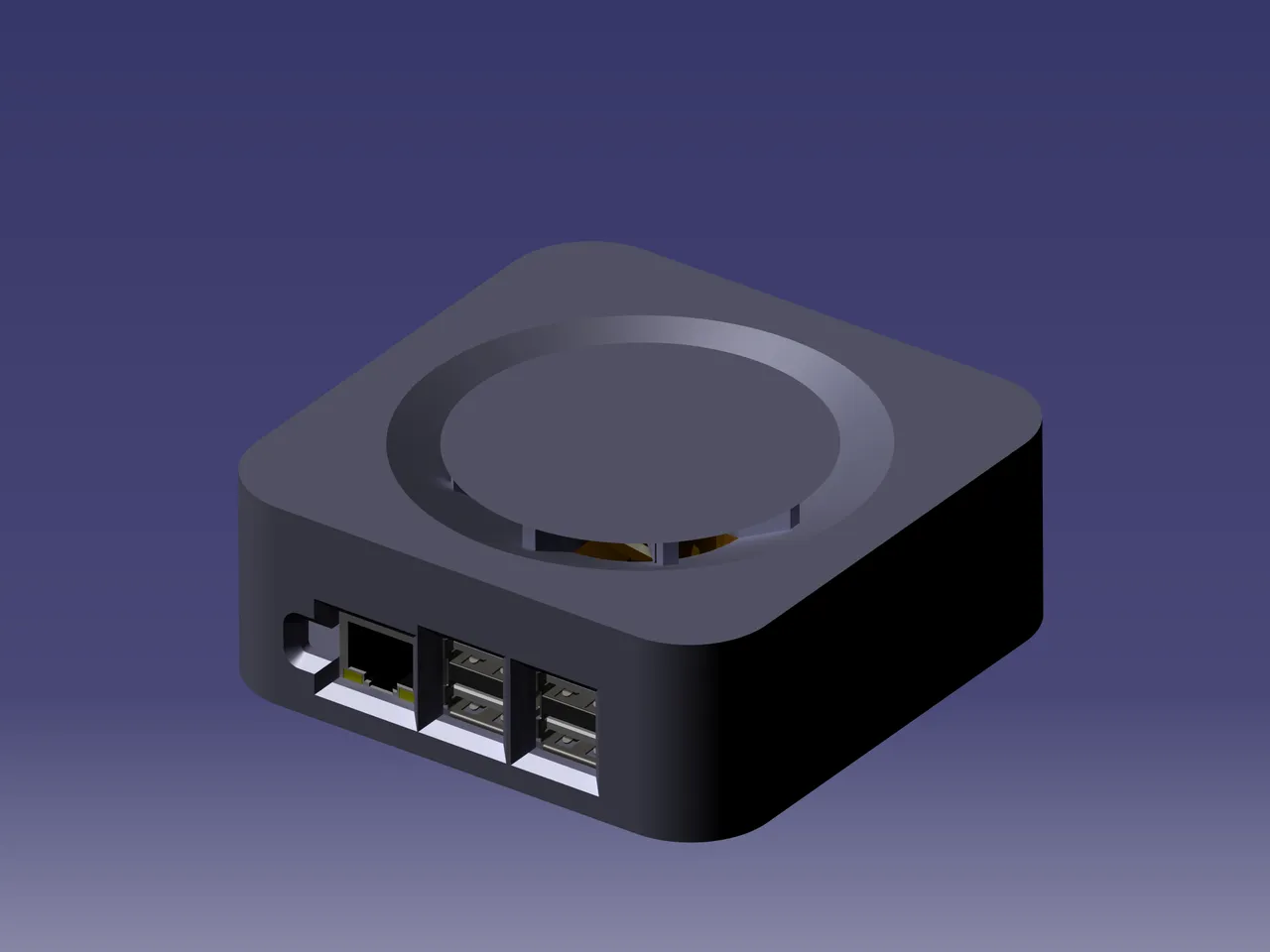

Raspberry Pi 3 case with 40mm fan (Apple TV like) by Sebastian | Download free STL model | PrusaPrinters

Raspberry Pi 3 case with 40mm fan (Apple TV like) by Sebastian | Download free STL model | PrusaPrinters

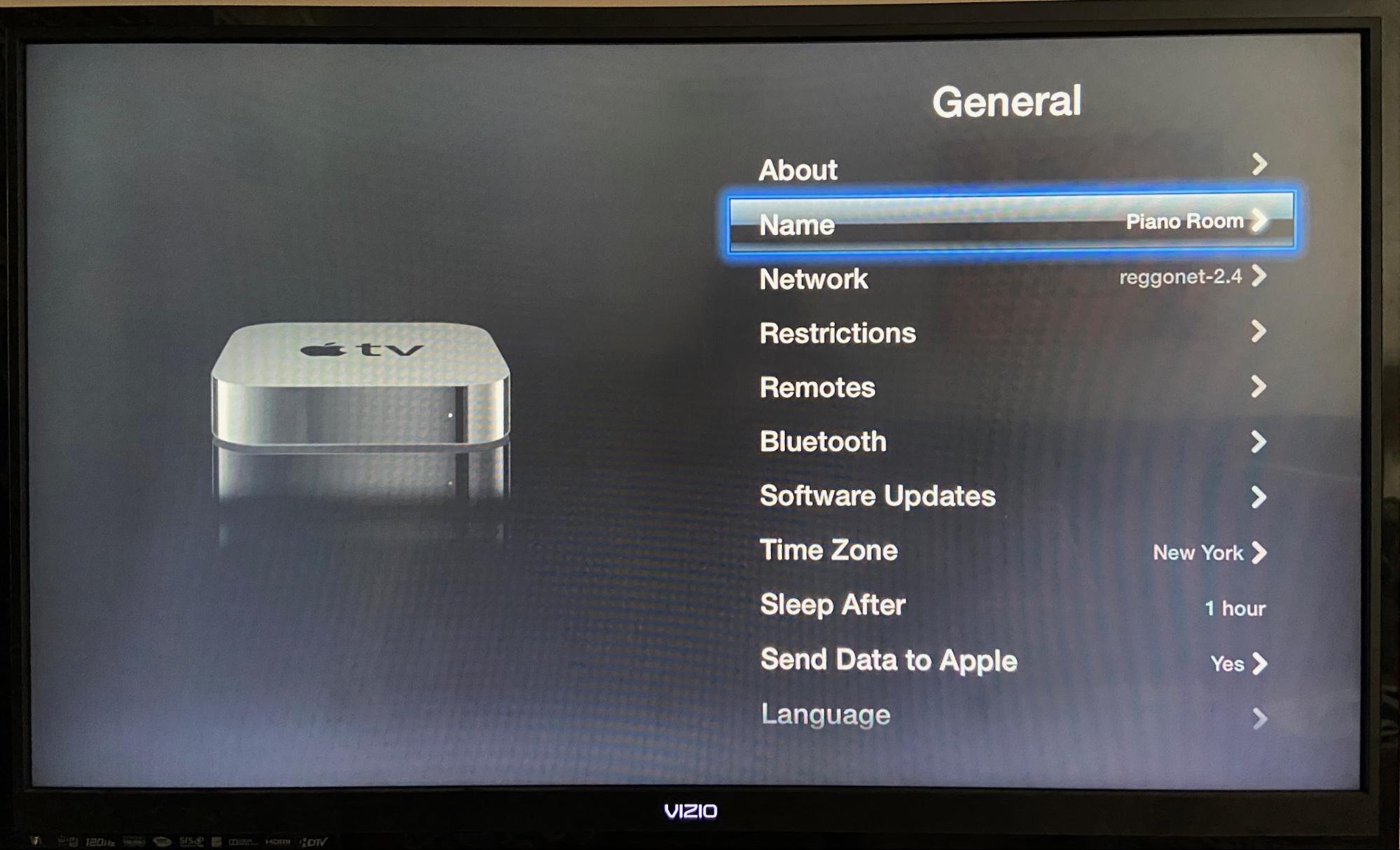

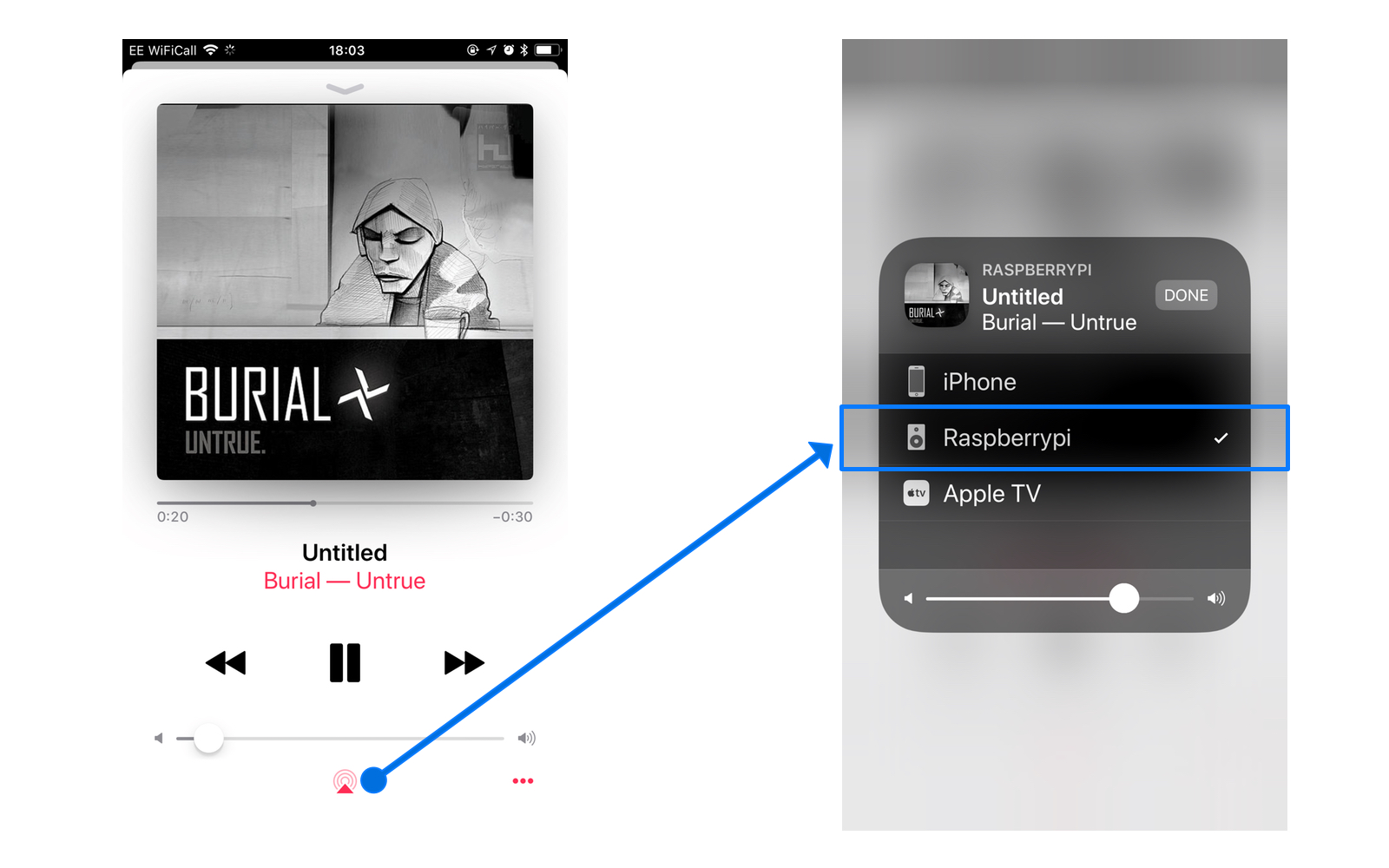

Took a few hours this weekend to download Apple TV aerial videos and automatically loop through them on my Raspberry Pi 2, super happy with the final result! : r/raspberry_pi