Kermi – Profil x2-k Typ22 BH600 x 100 x 1600 mm QN2666, weiß, 10 bar, Herrn Gehäuse, VE8 : Amazon.de: Baumarkt

Kermi Kompakt-/Austauschheizkörper im HD24 Onlineshop günstig kaufen - Heizung und Solar zu Discountpreisen

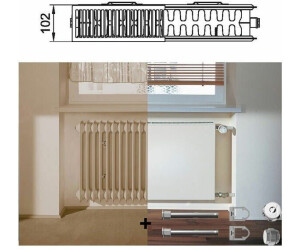

Kermi Kompakt-/Austauschheizkörper / x2 Plan-K-AT Typ 22 / 559x1005mm / günstig kaufen - Heizung und Solar zu Discountpreisen