Buy AMT 1967 Chevy Impala 4-Door Supernatural Night Hunter TV Show Model Kit Replica Online at Low Prices in India - Amazon.in

1967 Chevrolet Impala Sport Sedan Supernatural Ohio Nummernschild 1:18 GreenLight 19014: Amazon.de: Toys & Games

Amazon.com: NEW 1:24 GREENLIGHT COLLECTIBLES - SUPERNATURAL - BLACK 1967 CHEVROLET IMPALA SPORT SEDAN Diecast Model Car By Greenlight : Home & Kitchen

Amazon.com: Supernatural 1/64 Die-Cast Car - 1967 Chevrolet Impala (Loot Crate Exclusive) : Arts, Crafts & Sewing

GreenLight Hollywood Supernatural Join The Hunt TV Series 1967 Chevrolet Impala Sport Sedan, 1:24, Cars - Amazon Canada

Greenlight 1: 18 Collection – Supernatural 1967 chevrolet impala ss – Ohio Plate 19014 by Greenlight: Amazon.de: Toys & Games

Amazon.com: SHVIEIART, Baby Supernatural 67 Impala Poster Metal Tin Sign 8In x 12In Vintage Retro Man Cave Wall Decor, 8Inx12In : Home & Kitchen

Amazon.com: Greenlight Hollywood 44692 1:64 Scale Supernatural 1967 Chevrolet Impala Sedan : Toys & Games

1967 Chevrolet Impala Sports Sedan Supernatural (TV Series 2005) 1/43 Diecast Model Car by Greenlight""" : Home & Kitchen - Amazon.com

Amazon.com: 1967 Chevrolet Impala Sports Sedan Supernatural (TV Series 2005) 1/43 Diecast Model Car by Greenlight""" : Home & Kitchen

Greenlight Supernatural 1967 Chevy Impala Sport, Black 19021 - 1/18 Scale Diecast Model Toy Car : Amazon.sg: Toys

Chevrolet Impala Sport Sedan, Black/Chrome, Supernatural, 1967, Model Car, Ready-made, Greenlight 1: 18: Amazon.de: Toys & Games

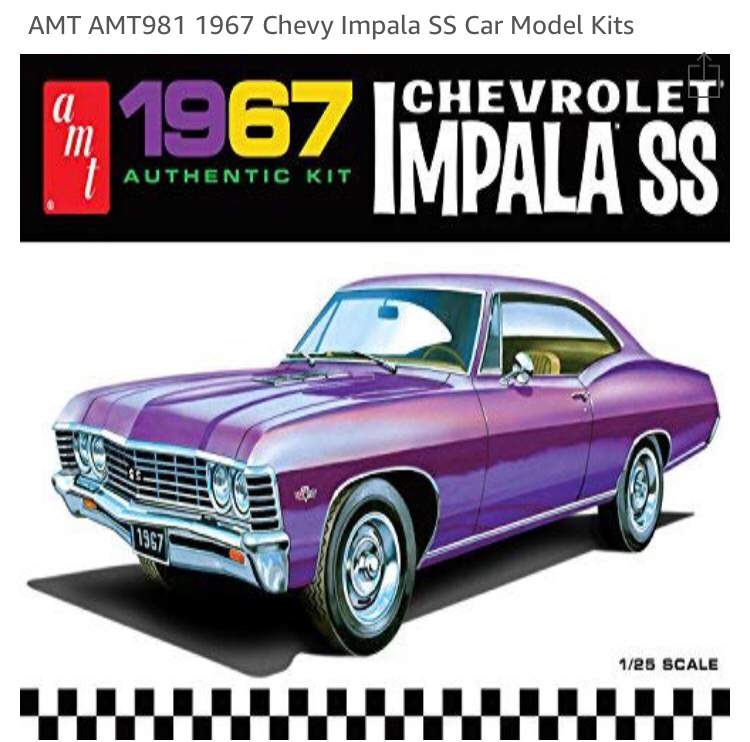

Amazon.com: AMT 1967 Chevy Impala 4-Door Supernatural Night Hunter TV Show Model Kit Replica : Arts, Crafts & Sewing

Amazon.com: Supernatural Gift Save A Chevy Impala Dean Winchester T-Shirt : Clothing, Shoes & Jewelry

Amazon.com: Supernatural Gift Save A Chevy Impala Dean Winchester Women Tank Top : Clothing, Shoes & Jewelry

Amazon.com: AMT 1967 Chevy Impala 4-Door Supernatural Night Hunter TV Show Model Kit Replica : Arts, Crafts & Sewing

Buy GL Hollywood 1967 Chevrolet Impala Sport Sedan From The Television Show Supernatural Greenlight 1:64 Online at Low Prices in India - Amazon.in