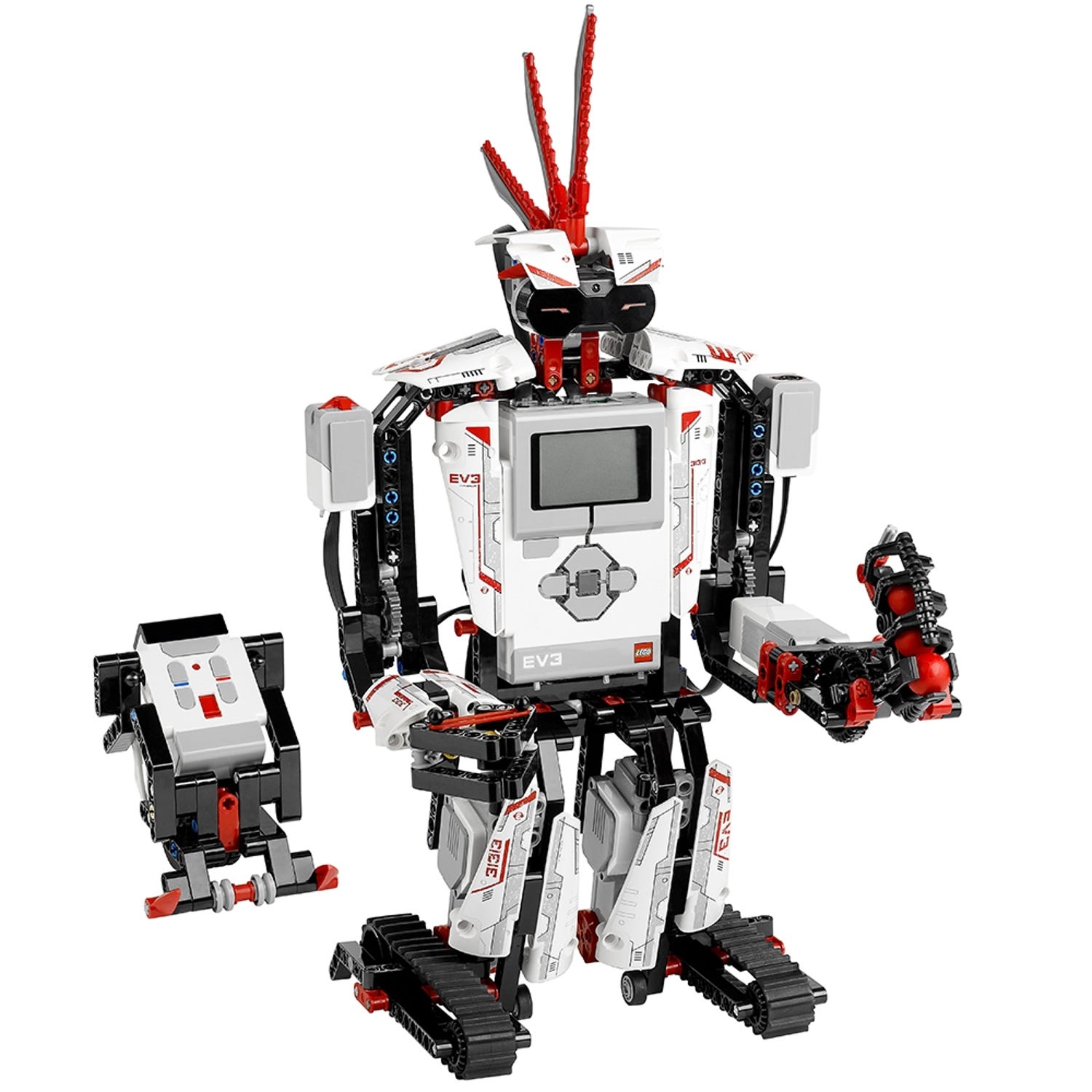

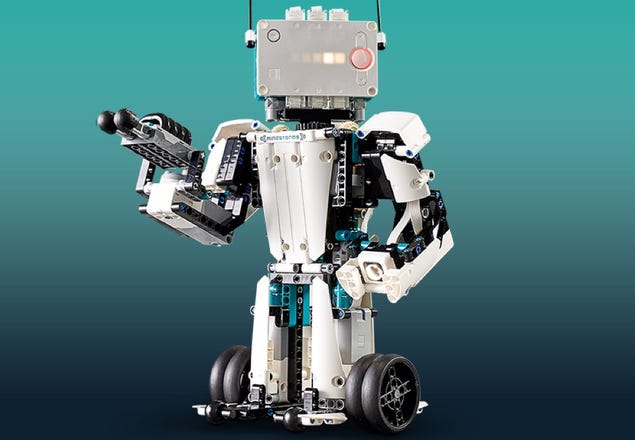

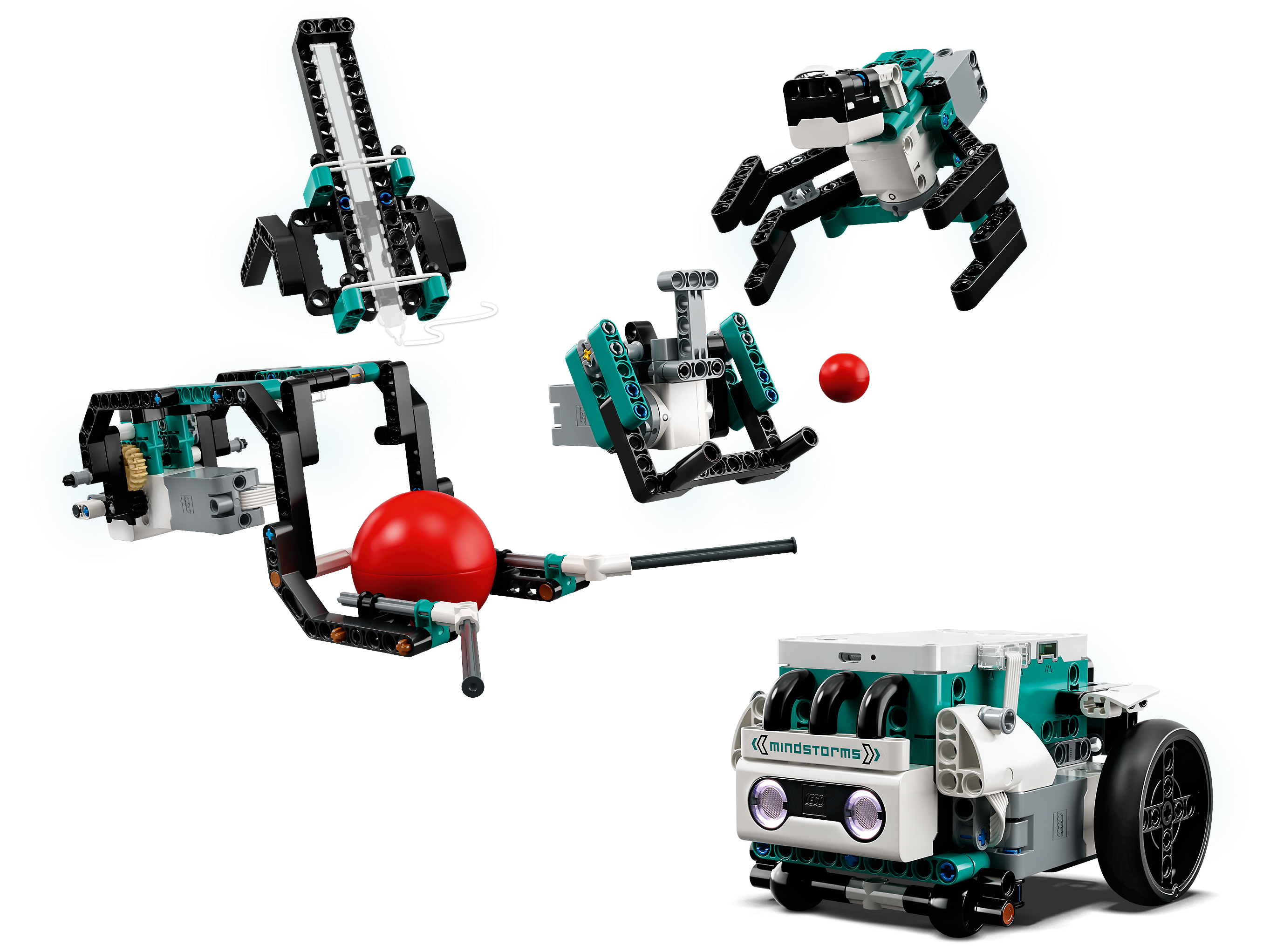

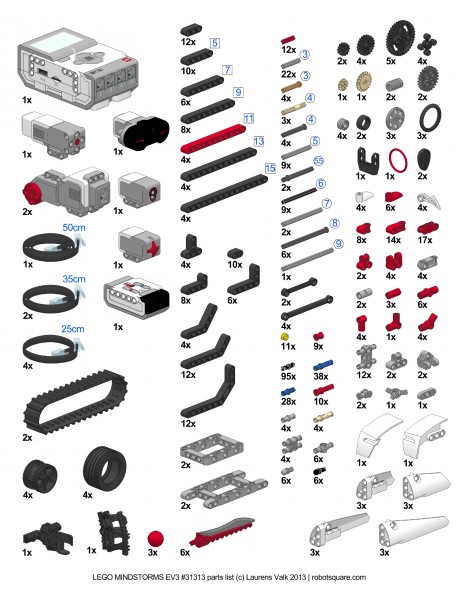

The Difference Between LEGO MINDSTORMS EV3 Home Edition (#31313) and LEGO MINDSTORMS Education EV3 (#45544) – Robotsquare

The Difference Between LEGO MINDSTORMS EV3 Home Edition (#31313) and LEGO MINDSTORMS Education EV3 (#45544) – Robotsquare

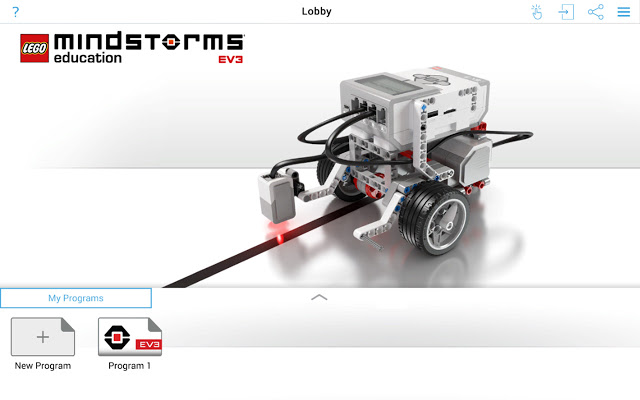

A creative process in LEGO Mindstorms EV3 part 2 | Eva Fog ⊢Foredrag | Consultant | Author | Opinion Danner | Underviser⊣