Wie Kartons als Schwer markieren? - Allgemeine Fragen zum Verkaufen bei Amazon - Amazon Seller Forums

10 x DHL Paketmarke bis 5kg Deutschland 120 x 60 x 60 Deutsche Post als PDF per Email : Amazon.de: Bürobedarf & Schreibwaren

تويتر \ gnirbel على تويتر: "@DHLPaket Oh, sorry, ich hätt auch die andere Seite des Umschlag fotografieren sollen, dort ist der DHL-Aufkleber. https://t.co/Y4CZhPUQYB"

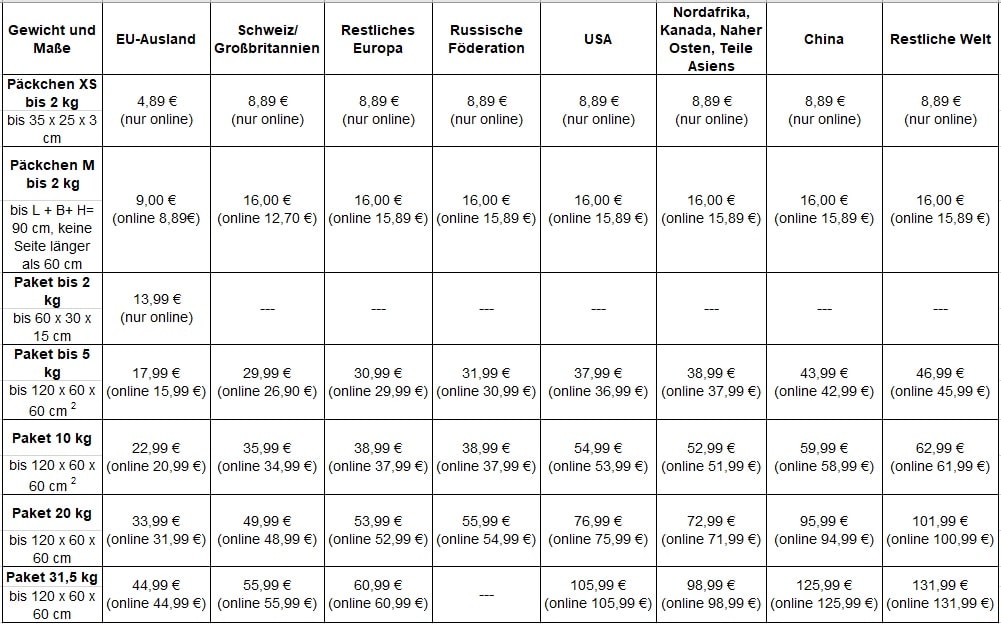

:fill(fff,true):no_upscale()/praxistipps.s3.amazonaws.com%2F2020-08%2FScreenshot_2020-08-25%2520DHL%2520Paket%2520Preis%25C3%25BCbersicht%2520Juli%25202020%2520-%2520dhl-paket-pk-preisuebersicht-07-2020%2520pdf_0.png)

:fill(fff,true):no_upscale()/praxistipps.s3.amazonaws.com%2F2020-08%2FScreenshot_2020-08-25%2520DHL%2520Paket%2520Preis%25C3%25BCbersicht%2520Juli%25202020%2520-%2520dhl-paket-pk-preisuebersicht-07-2020%2520pdf_0.png)

![Tipps] Deutsche Post: So verschickst du Päckchen und Pakete von Deutschland nach Japan | WanderWeib Tipps] Deutsche Post: So verschickst du Päckchen und Pakete von Deutschland nach Japan | WanderWeib](https://wanderweib.de/wp-content/uploads/2021/11/Hokokuji_Tempel-5-von-7.jpg)