Amazon.com: Ebike 48V 19.2AH Battery Tesla Cell Down Tube Lithium Battery for Electric Bike Li-ion Battery for Electric Bicycle 250W 500W 750W 1000W 1500W with 5A Charger : Sports & Outdoors

Amazon.com: Ebike 48V 19.2AH Battery Tesla Cell Down Tube Lithium Battery for Electric Bike Li-ion Battery for Electric Bicycle 250W 500W 750W 1000W 1500W with 5A Charger : Sports & Outdoors

Ebike 48V 19.2AH Battery Tesla Cell Down Tube Lithium Battery for Electric Bike Li-ion Battery for Electric Bicycle 250W 500W 750W 1000W 1500W with 5A Charger : Sports & Outdoors - Amazon.com

Amazon.com: Tesla 4680 Battery 1:1 Scale Replica - Multi-Piece Assembly with Display Cradle : Patio, Lawn & Garden

Amazon.com: Tesla Coil,Mini Tesla Coil for Dry Battery Powered,No Arc Remote Ignition Tesla Electronic DIY Kit,no Electricity, no Arc, only Light (Unfinished) : Arts, Crafts & Sewing

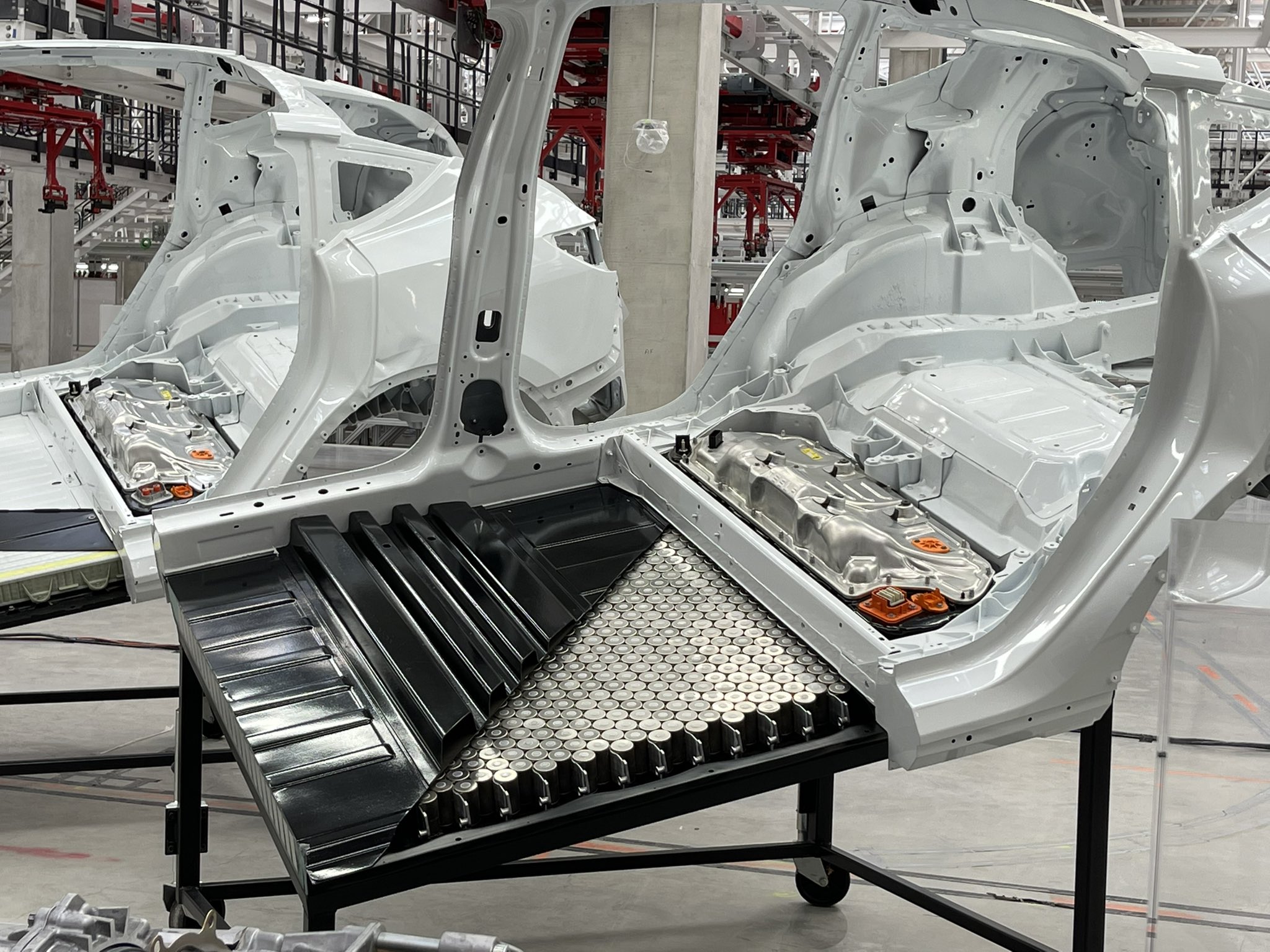

Tesla shows off Model Y with structural 4680 battery pack (and much more) at Giga Fest - Drive Tesla

Tesla applies to build giant new cathode factory for battery production next to 'Gigafactory Texas' - Electrek

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/46248086/teslaenergy_utility1.0.0.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/OEO3CCZGQFMAVE4MKC2SZTOFHM.jpg)