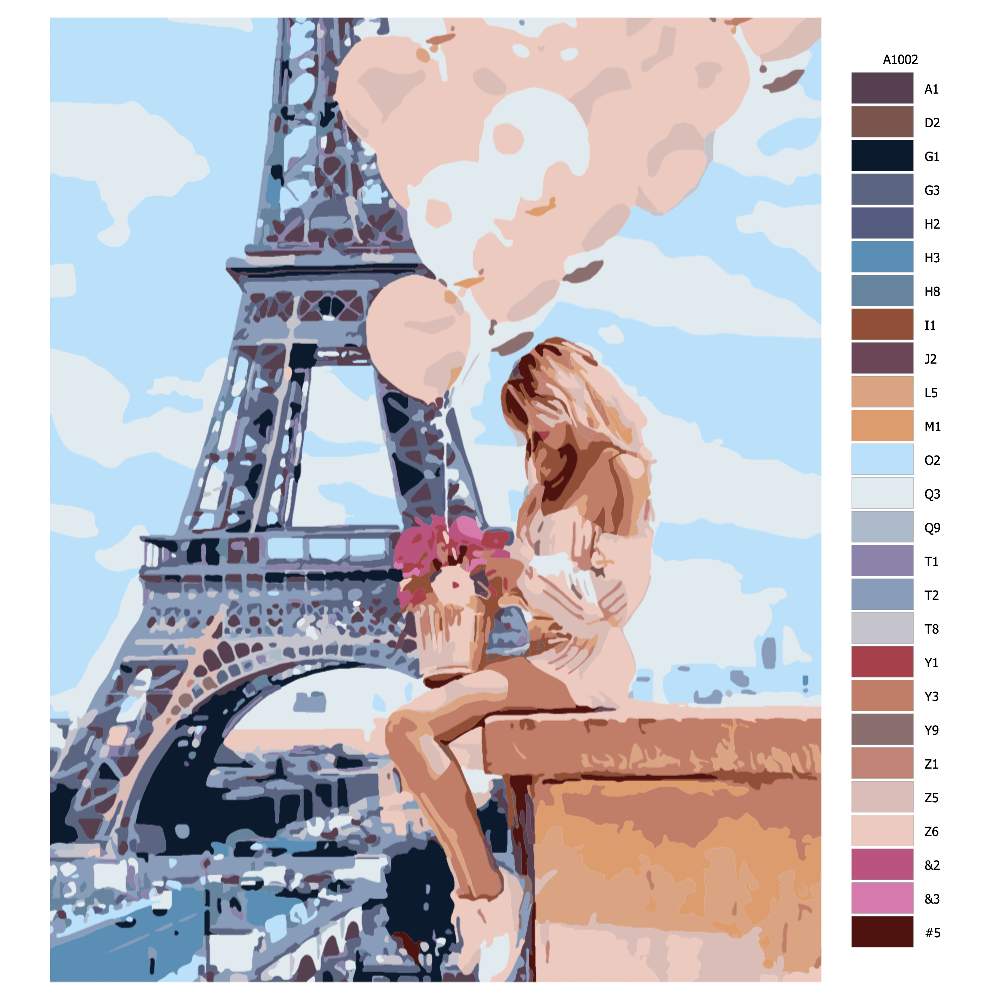

Malování podle čísel - ŽENA S MNOHA BALONKY U EIFFELOVKY Rozměr: 30x40 cm, Rámování: bez rámu a bez vypnutí plátna | Malování

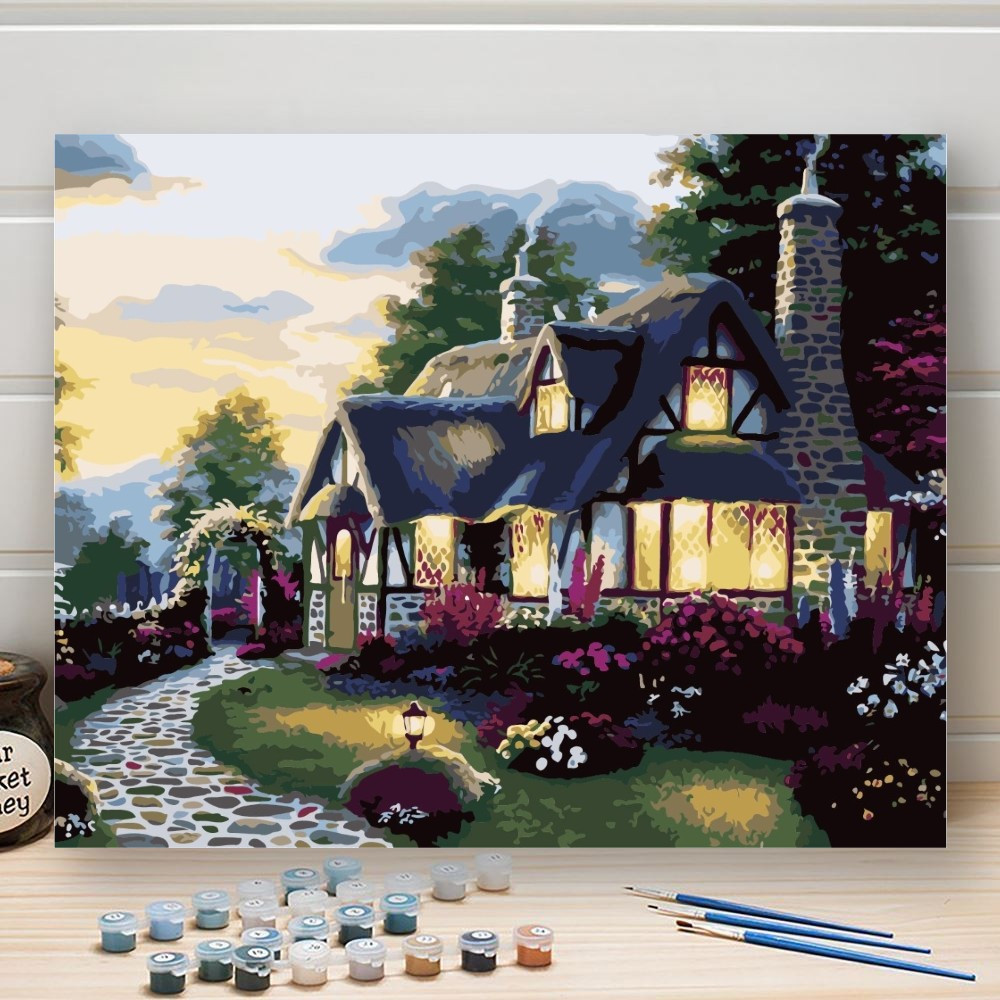

Malování podle čísel - RUŠNÁ ULICE A EIFFELOVA VĚŽ Rozměr: 80x100 cm, Rámování: vypnuté plátno na rám | Malování

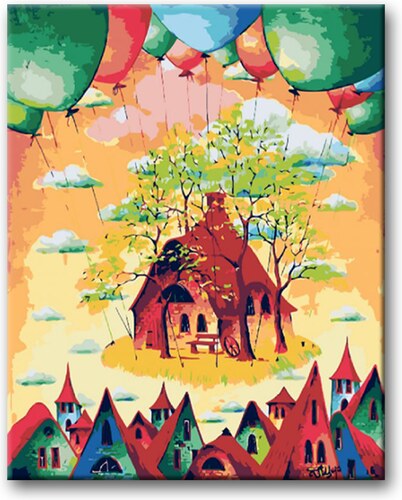

ZUTY Malování podle čísel - BAREVNÉ DOMKY S BALONKY Rozměr: 40x50 cm, Rámování: vypnuté plátno na rám - GLAMI.cz