ECD Germany presenning til vandtank 1000 L 120 x 100 x 116 cm med udskæring i sort - beskyttelsesdæksel beskyttende hætte beskyttende presenning | CDON

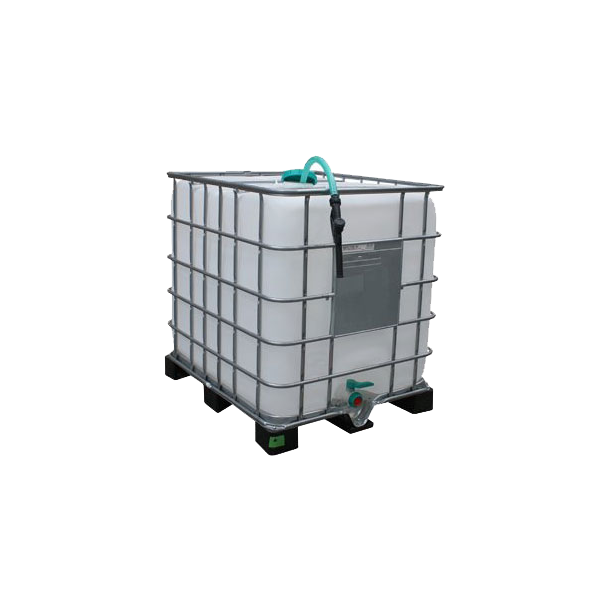

Stationær vandtank med pumpe/slange påfyldningskit - Vandtanke, stationære til opbevaring - NOWAS A/S