New York Museum of Modern Art (MoMA) Partnership (U.S.)│Unlocking The Power of Clothing. UNIQLO Sustainability

Yayoi Kusama & Uniqlo SPRZ NY MOMA Tote Bag Black Japan Free Shipping New Rare #YayoiKusamaUniqlo | Yayoï kusama, Sac

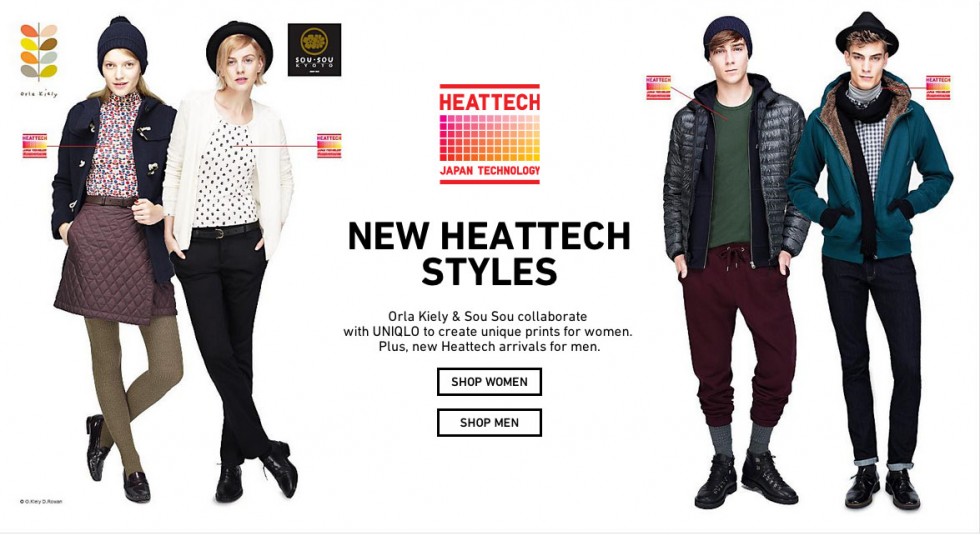

New York Museum of Modern Art (MoMA) Partnership (U.S.)│Unlocking The Power of Clothing. UNIQLO Sustainability

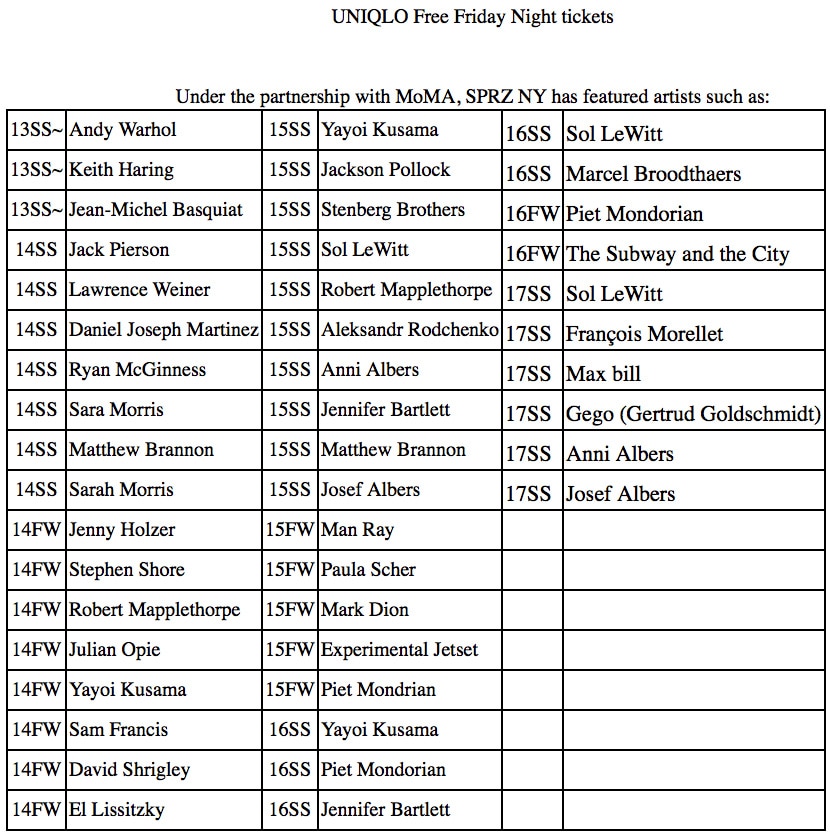

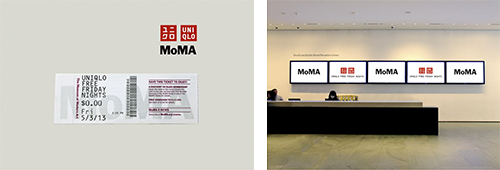

UNIQLO to Become the Exclusive, Multi-Year Sponsor of the Museum of Modern Art's Popular Free Friday Night Admission Program | FAST RETAILING CO., LTD.