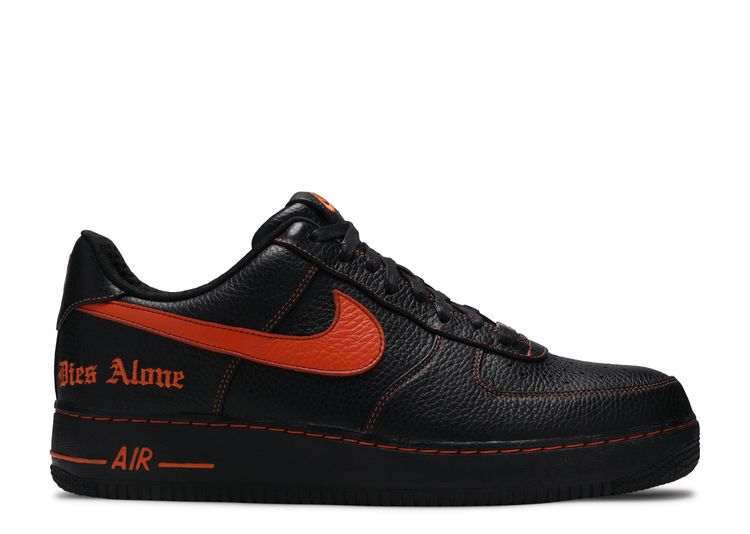

Vlone x presto Nike Air Force 1 07 Low White Black GT6969 - Ariss-euShops - 198 - presto nike air jordan future suede boots sale kids shoes

111 - Discount 2020 Vlone x Pauly x Nike Air Force 1 “Mase” Graffiti pattern 315122 - nike sb skunk dunk high blue boots 2017