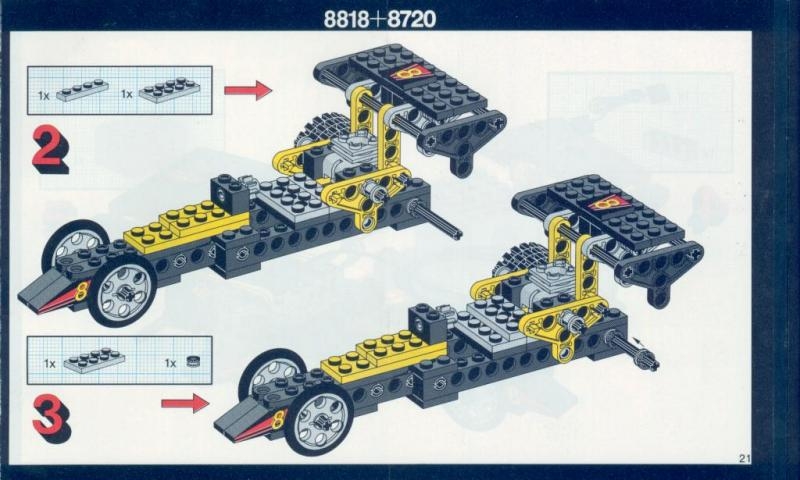

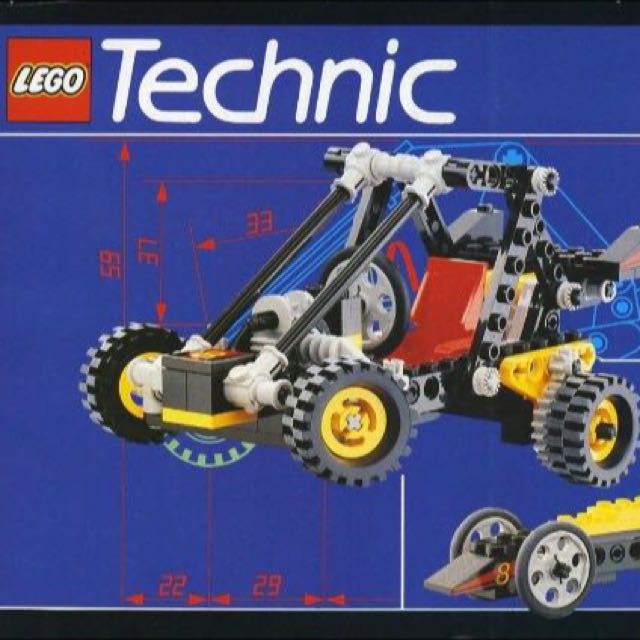

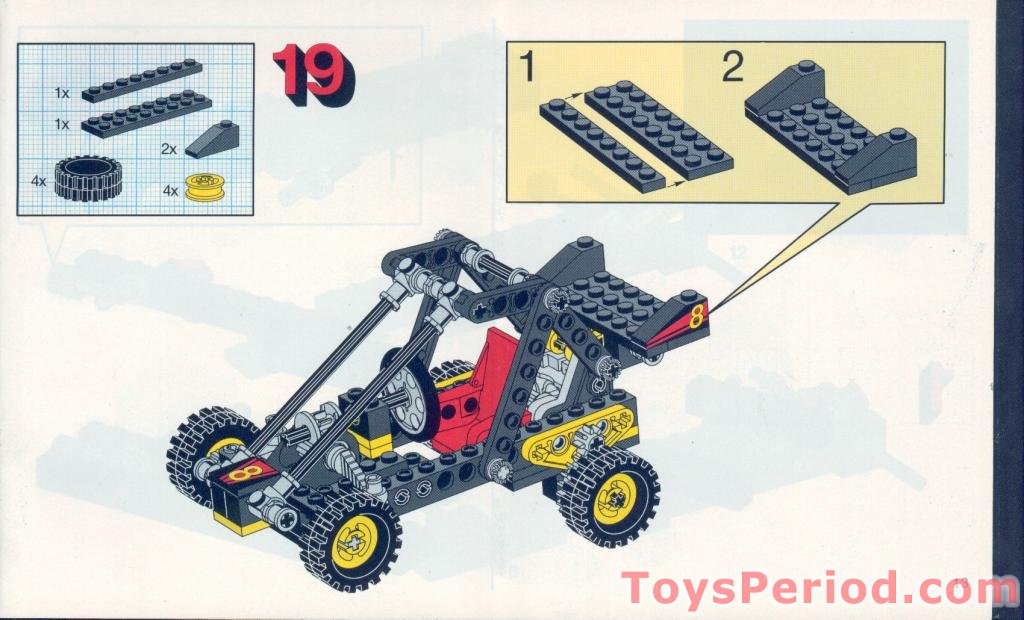

![BrickLink - Set 8818-1 : LEGO Baja Blaster / Desert Racer [Technic:Model:Off-Road] - BrickLink Reference Catalog BrickLink - Set 8818-1 : LEGO Baja Blaster / Desert Racer [Technic:Model:Off-Road] - BrickLink Reference Catalog](https://img.bricklink.com/ItemImage/ON/0/8818-1.png)

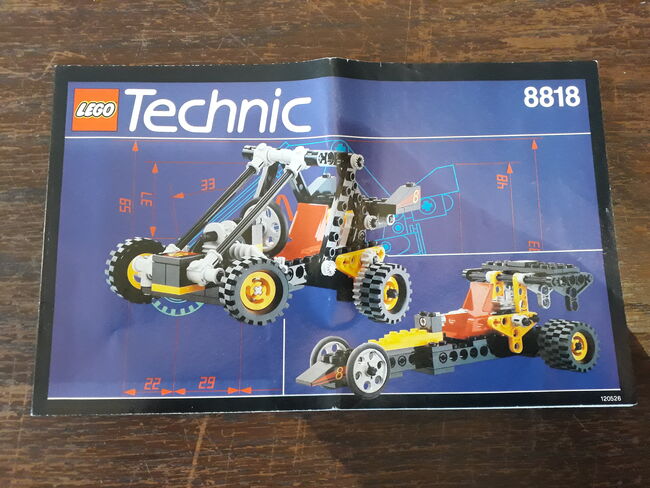

BrickLink - Set 8818-1 : LEGO Baja Blaster / Desert Racer [Technic:Model:Off-Road] - BrickLink Reference Catalog

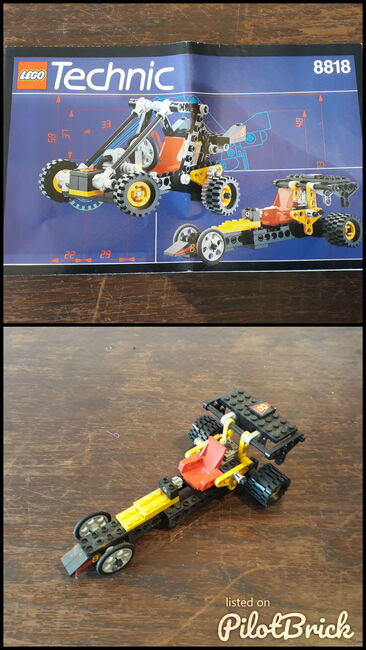

Lot-Art | Lego Technic, to include: Boxes No. 8448, No. 8449, No. 8824, No. 8818, No. 8205, No. 8810 and No. 8210 (contents not verified)...

![BrickLink - Set 8818-1 : LEGO Baja Blaster / Desert Racer [Technic:Model:Off-Road] - BrickLink Reference Catalog BrickLink - Set 8818-1 : LEGO Baja Blaster / Desert Racer [Technic:Model:Off-Road] - BrickLink Reference Catalog](https://img.bricklink.com/ItemImage/SL/8818-1.png)

.jpg)