iNeedKit Upgraded Cooling Gel Earpads Compatible with Bose QuietComfort 35 QC35, QC35ii) Over-Ear Headphones Ear Pads Cushions

Ineedkit Upgraded Cooling Gel Earpads Compatible With Bose Quietcomfort 35 Qc35, Qc35ii) Over-ear Headphones Ear Pads Cushions - Earphone Accessories - AliExpress

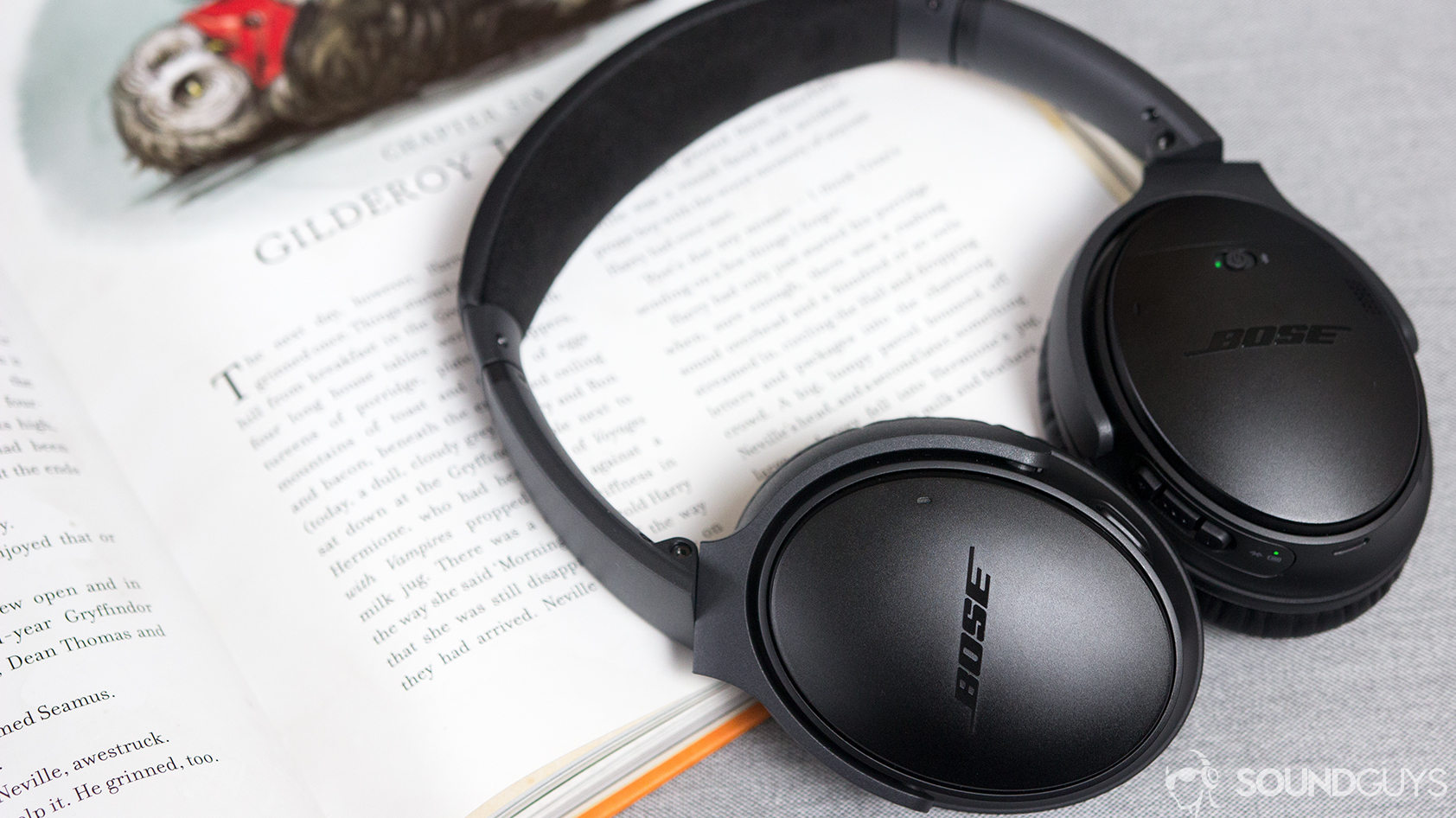

Bose QC 35 II Bluetooth Headphones with Google Assistant Launched: Price and Specification - Smartprix Bytes

Suitable for BOSE Quiet Comfort 35 II QC35II Detachable Gaming Noise Cancelling Headphone Headset Microphone Game Headset Cable

Bose QC35 II headphones - near new - Electronics & Computers - Sydney, Australia | Facebook Marketplace | Facebook

Amazon.com: Bose QuietComfort 35 II Noise Cancelling Bluetooth Headphones— Wireless, Over Ear Headphones with Built in Microphone and Alexa Voice Control, Silver : Electronics