The 6-m Millimeter-Wave Radio Telescope Added to Japan Astronomical Heritage List | NAOJ: National Astronomical Observatory of Japan - English

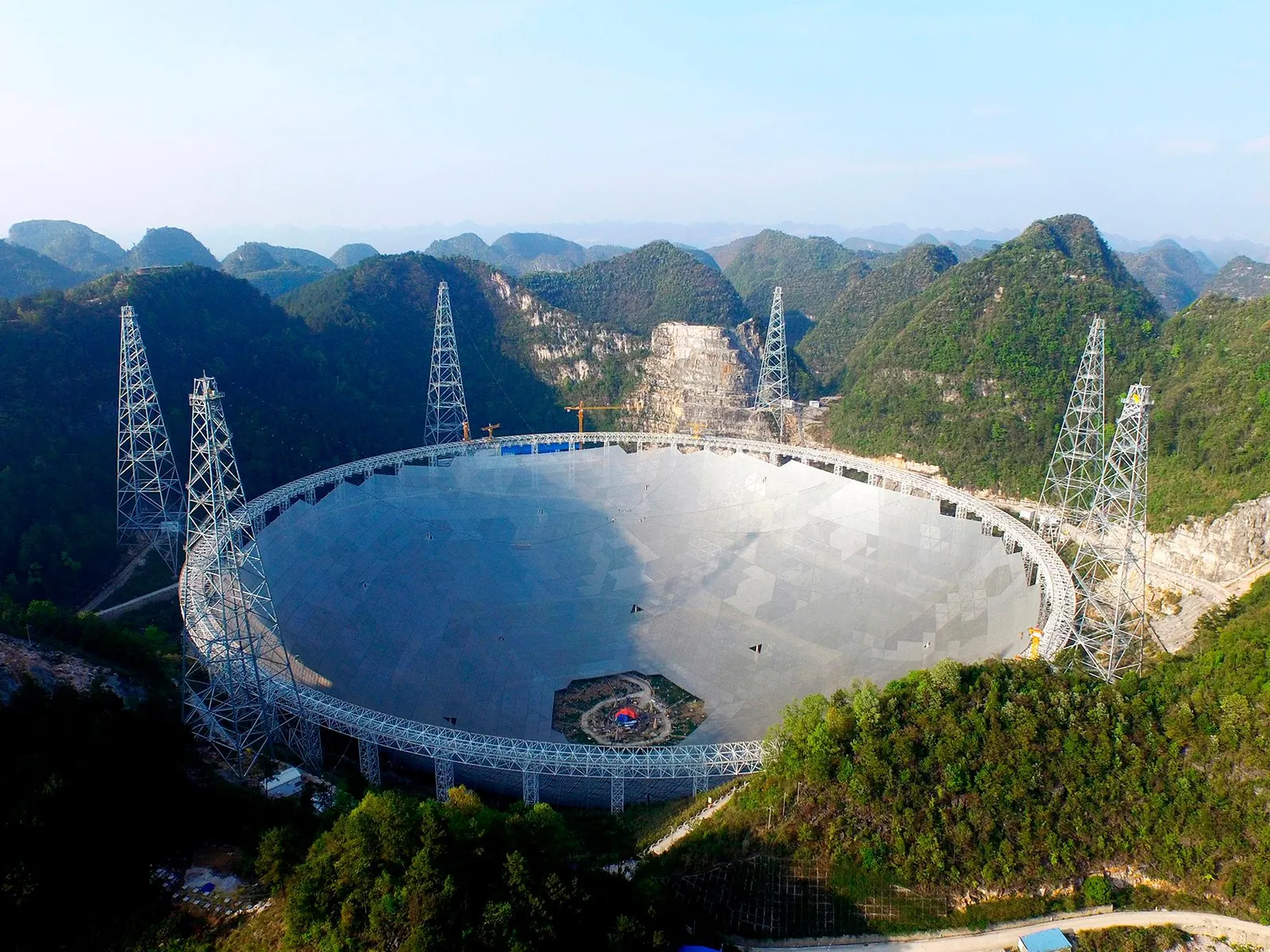

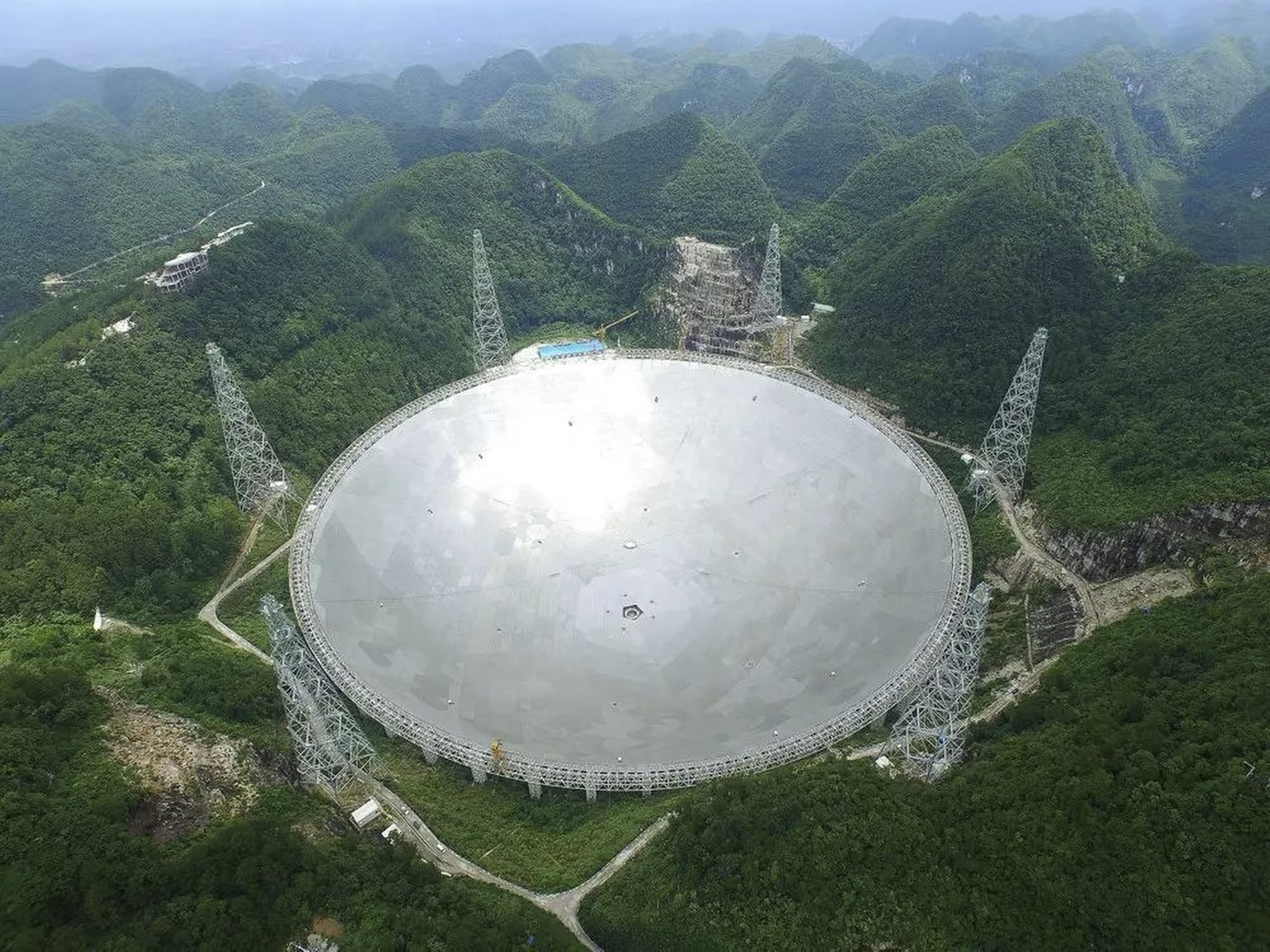

China's FAST is world's only giant, single-dish radio telescope after Arecibo collapse | South China Morning Post

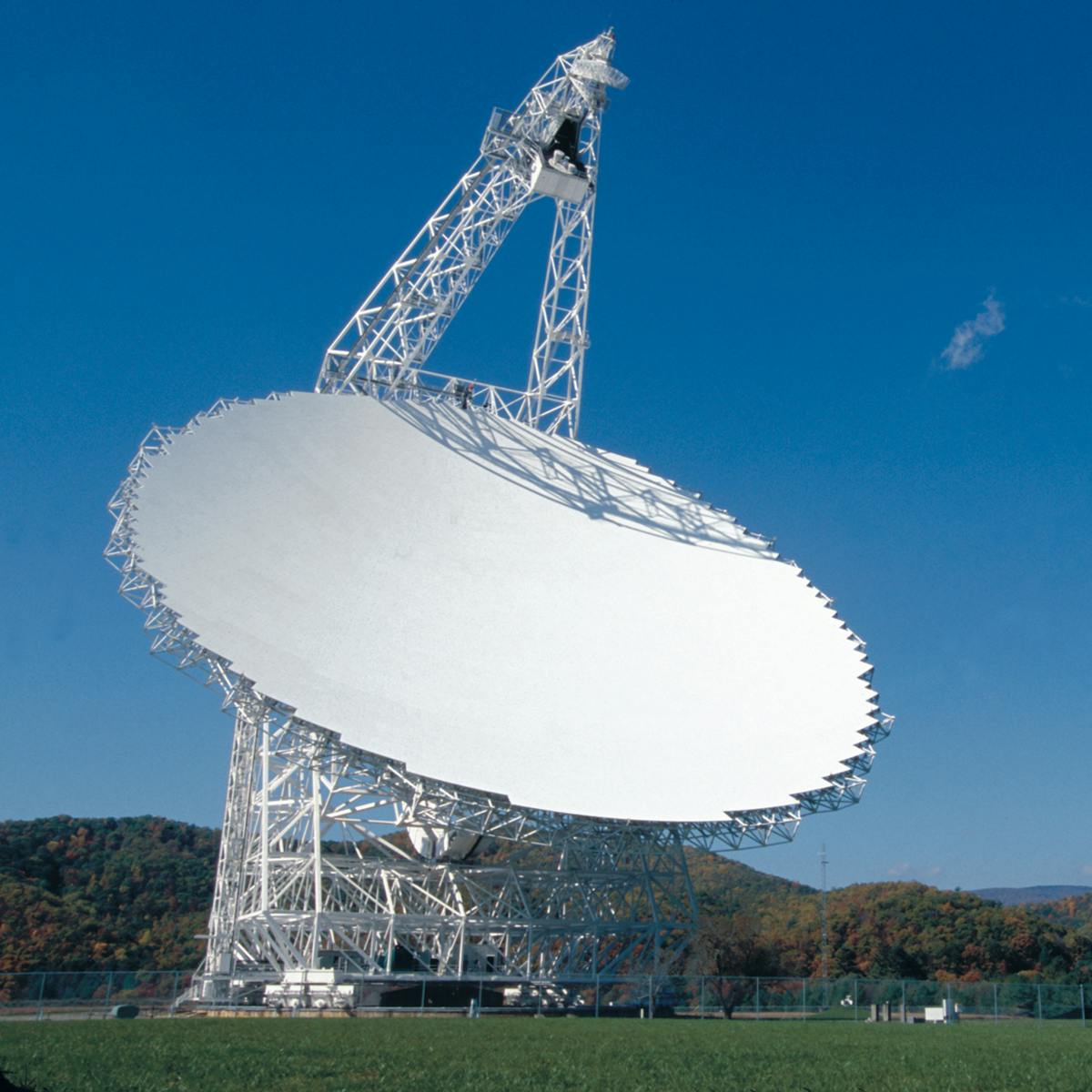

Radio interference from satellites is threatening astronomy – a proposed zone for testing new technologies could head off the problem