Nike AIR MAX OKETO GS Fekete / Rózsaszín - Ingyenes Kiszállítás | SPARTOO.HU ! - Cipők Rövid szárú edzőcipők Gyerek 18 439 Ft

NIKE W AIR MAX VERONA CU7846-600 ✓ RÓZSASZíN ✓ 33 291,00 Ft! Legendás Sportcipő ✓ Női Cipő Nike a ✪ Sizeer üzletben ✪

NIKE AIR MAX 90 CZ6221-600 ✓ RÓZSASZíN ✓ 36 792,00 Ft! Legendás Sportcipő ✓ Női Cipő Nike a ✪ Sizeer üzletben ✪

Shoes NIKE - Air Max 720 AR9293 602 Light Soft Pink/Gym Red - Sneakers - Low shoes - Women's shoes | efootwear.eu

Vásárlás: Nike W AIR MAX DIA Cipők - 41 EU | 7 UK | 9, 5 US | 26, 5 CM - top4running - 37 530 Ft Sportcipő árak összehasonlítása, W AIR MAX DIA Cipők 41 EU 7 UK 9 5 US 26 5 CM top 4 running 37 530 Ft boltok

NIKE AIR MAX 90 CZ6221-600 ✓ RÓZSASZíN ✓ 36 792,00 Ft! Legendás Sportcipő ✓ Női Cipő Nike a ✪ Sizeer üzletben ✪

NIKE W AIR MAX VERONA CU7846-600 ✓ RÓZSASZíN ✓ 33 291,00 Ft! Legendás Sportcipő ✓ Női Cipő Nike a ✪ Sizeer üzletben ✪

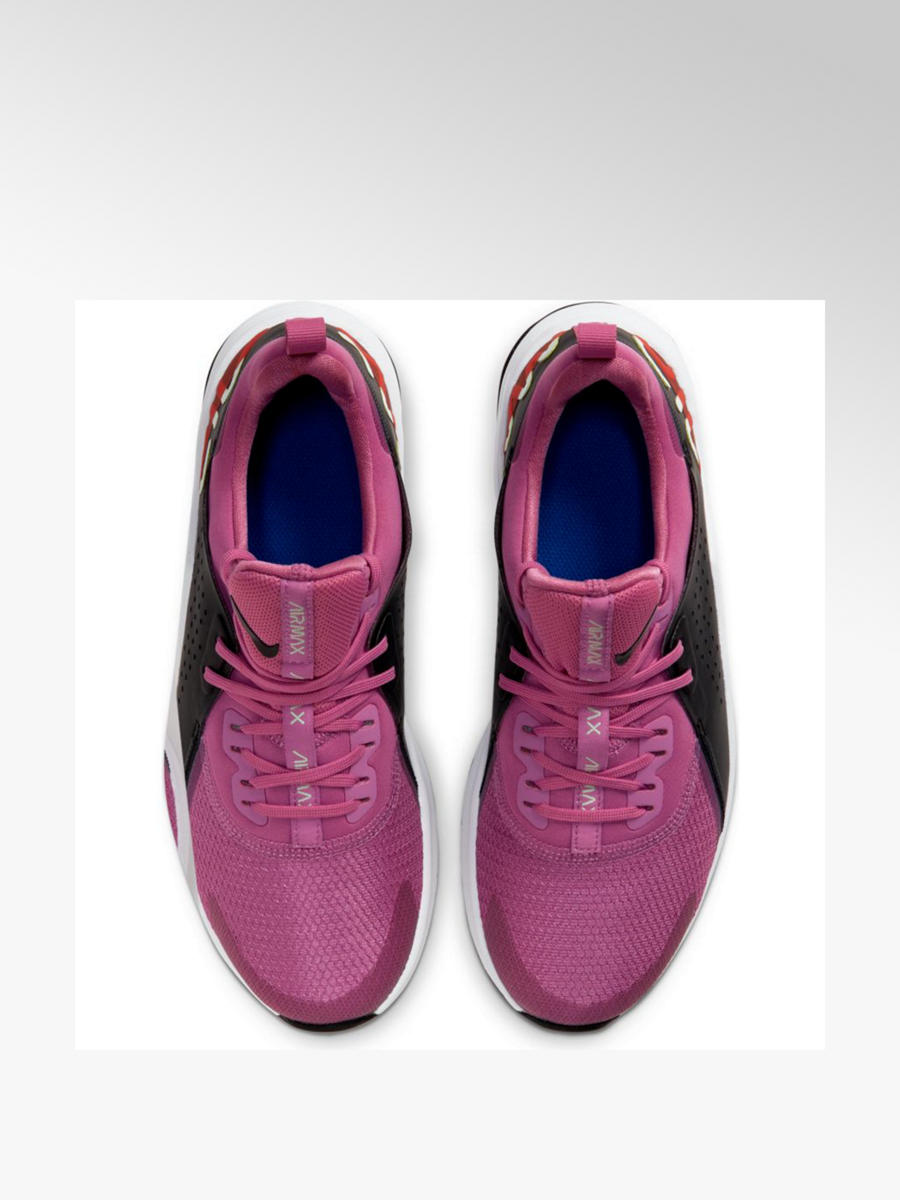

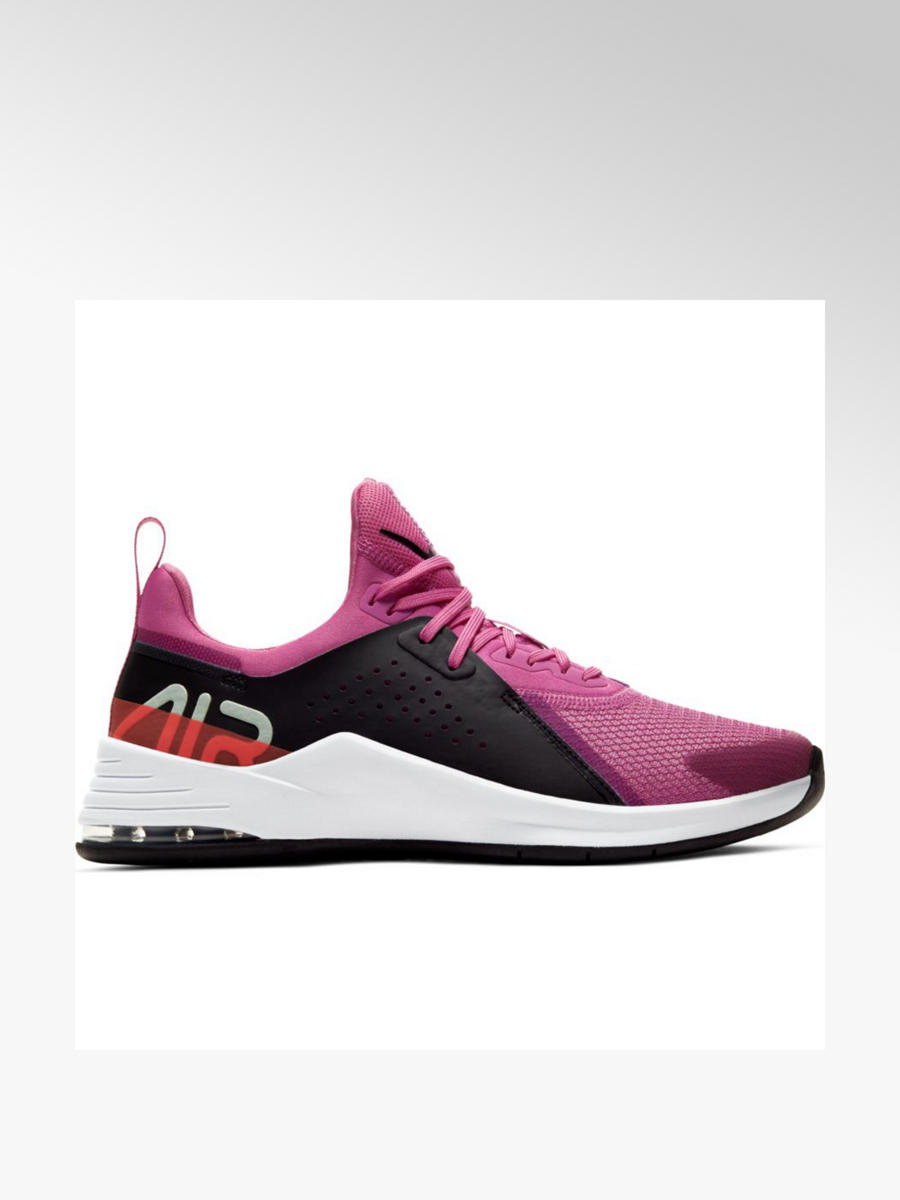

NIKE AIR MAX EXOSENSE CK6922-600 ✓ RÓZSASZíN ✓ 31 992,00 Ft! Legendás Sportcipő ✓ Női Cipő Nike a ✪ Sizeer üzletben ✪

Nike AIR MAX '97 PREMIUM W Rózsaszín - Ingyenes Kiszállítás | SPARTOO.HU ! - Cipők Rövid szárú edzőcipők Noi 53 887 Ft

Nike AIR MAX 95 PREMIUM W Rózsaszín - Ingyenes Kiszállítás | SPARTOO.HU ! - Cipők Rövid szárú edzőcipők Noi 45 202 Ft

:fill(ffffff)/http://static-catalog.supersports.co.th/p/nike-7525-25137-1.jpg)