Napoleon Grills Built In LEX 605 4 Burner Natural Gas BBQ & Rear & Bottom Burners - Black - My Slice of Life

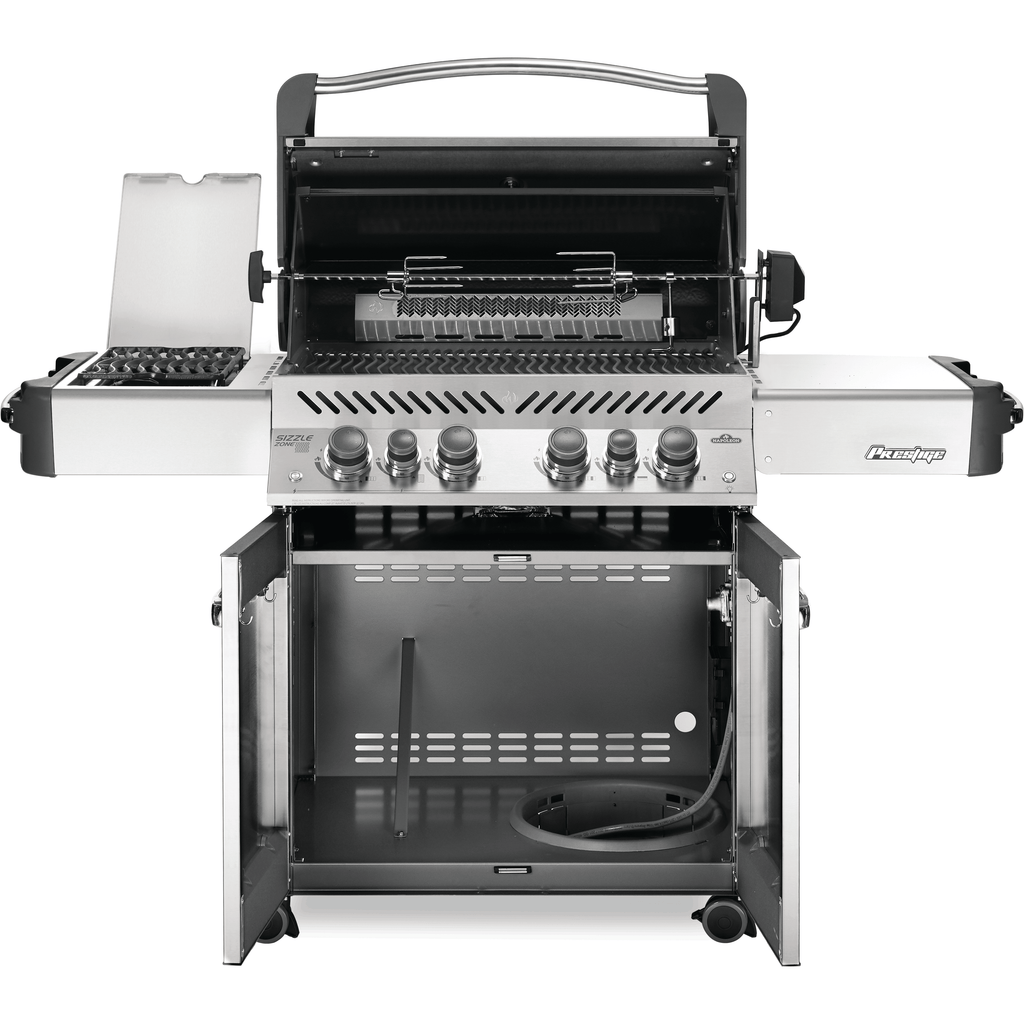

Amazon.com: Napoleon P500RSIBPSS-3 Prestige 500 RSIB Propane Gas Grill, sq. in + Infrared Side and Rear Burner, Stainless Steel : Everything Else

Napoleon Rogue SE 525 4-Burner 76,500 BTU Propane Gas Grill with Infrared Side Burner and Rear Burners - RSE525RSIBPSS-1 | Leon's

RSE425SBPSS Napoleon Grills Rogue BBQ Grill Canada Parts Discontinued - Sale! Best Price, Reviews and Specs - Toronto, Ottawa, Montréal, Vancouver, Calgary

Napoleon PTSS215P 26 Inch Portable Gas Grill with 14000 BTU Burner, QUICKSNAP Latch, Wind Resistant, 320 sq. in. Cooking Surface and Folding Legs: Tube Burner

Napoleon PRO825RSBISS-3 Prestige PRO 825 Series Gas Grill On Cart with Rotisserie and Side Burner, 45-Inches

)

)