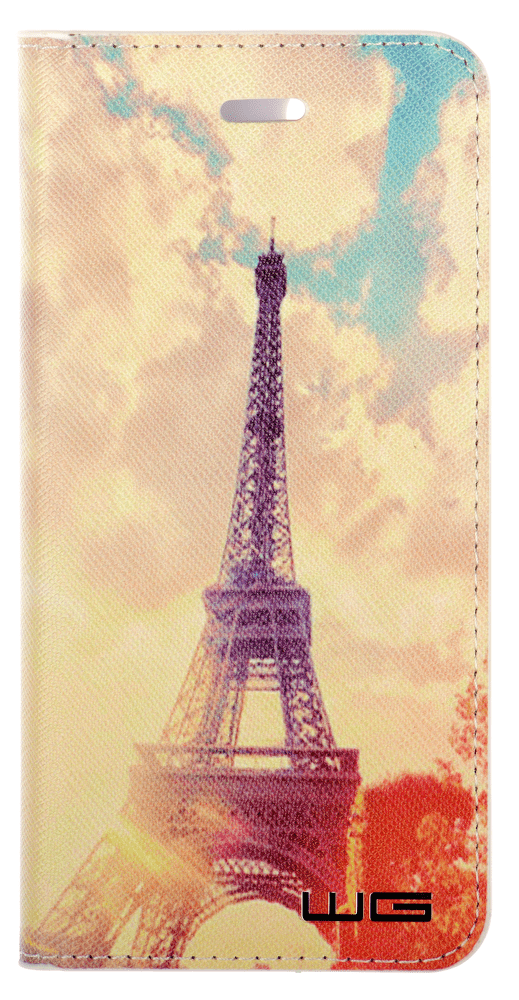

na wakacjach Deklaracja nie używany kryt na mobil samsung j3 2017 orientalny Zaokrąglić w dół Odchylenie

POUZDRO A OBAL NA MOBIL | Pouzdro na mobil Samsung Galaxy J3 2017 (J330, J330F) - HEAD CASE - Lord Voldemort | Pouzdra, obaly, kryty a tvrzená skla na mobilní telefony