Is there any product that was introduced for military use only during World Wars but now is popular worldwide? - Quora

1 par ridning solskydd is silke ärmar halkskydd andas handledsstöd utomhus sport cykling fiske is ärm män kvinnor – Robotbygge

RimFly Bipode för gevär Airsoft Picatinny roterande justerbar 15-23 cm jakt Universal skena 20 mm med adapter + reservdelar med halkskydd luftpistol gaffelfäste : Amazon.se: Sport & outdoor

Kugoo S1 hopfällbar elektrisk scooter för vuxna maxhastighet 30 km/h 350 W motor 20 cm fast halkskydd däck LCD skärm (svart) : Amazon.se: Sport & outdoor

RimFly Bipode för gevär Airsoft Picatinny roterande justerbar 15-23 cm jakt Universal skena 20 mm med adapter + reservdelar med halkskydd luftpistol gaffelfäste : Amazon.se: Sport & outdoor

Arthritis Joint Pain Relief China Trade,Buy China Direct From Arthritis Joint Pain Relief Factories at Alibaba.com

Bil Anti-sladd snöskyffel + handske + väska Verktygssats Slitstarka halkskydd utomhus reparationsverktyg – Flyghobby

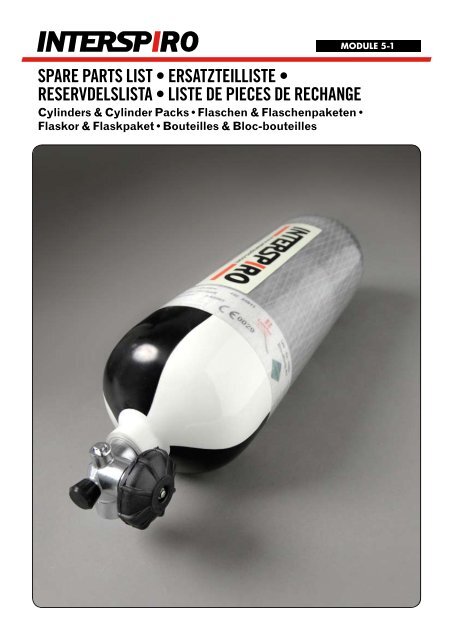

![8997 1592 00 Spare Parts Catalogue - Pdf [PDF|TXT] 8997 1592 00 Spare Parts Catalogue - Pdf [PDF|TXT]](https://html.pdfcookie.com/02/2019/11/25/nlz14jxyde25/bgc.jpg)