https://www.lepuitsauxlivres.com/fr/ 1.0 weekly https://www.lepuitsauxlivres.com/fr/nous-contacter 0.1 weekly https://www.lepuitsauxlivres.com/fr/ 0.1 weekly https://www.lepuitsauxlivres.com/fr/fabricants 0.7 weekly https://www.lepuitsauxlivres.com/fr/nouveaux ...

https://www.lepuitsauxlivres.com/fr/ 1.0 weekly https://www.lepuitsauxlivres.com/fr/nous-contacter 0.1 weekly https://www.lepuitsauxlivres.com/fr/ 0.1 weekly https://www.lepuitsauxlivres.com/fr/fabricants 0.7 weekly https://www.lepuitsauxlivres.com/fr/nouveaux ...

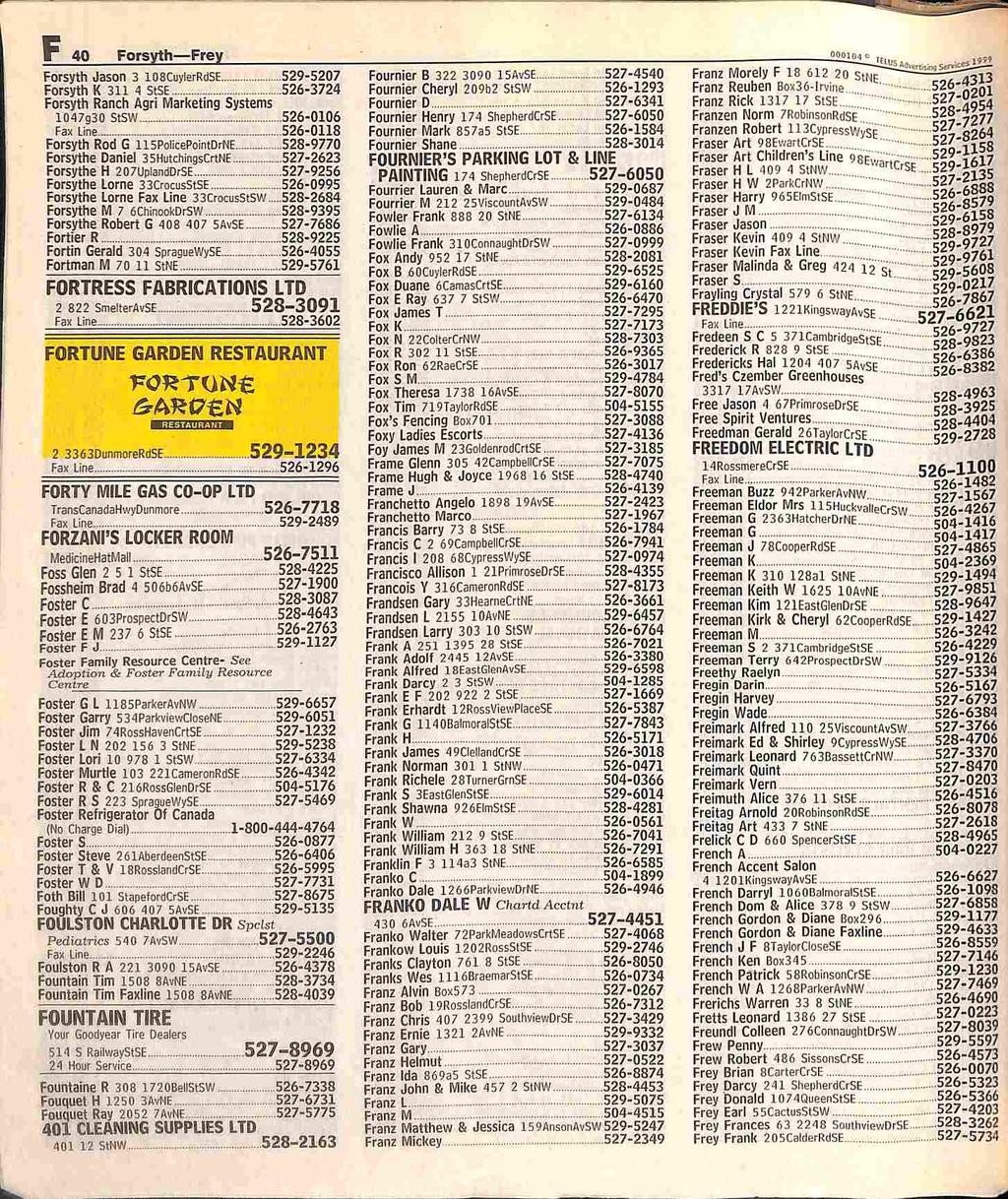

DOYLE LINDY J Chartd Acclnt 211 ISGSDunmoreRdSE Doyle Mike 9630QminionStSE. Doyle P B 700RDSsGlenDrSE Doyle R - PDF Téléchargement Gratuit

https://www.wohnfuehlidee.de/ always 1.0 https://www.wohnfuehlidee.de/DOLLE-Tuer-und-Treppengitter-Pia-Kindersicherheitsgitter-Massivholz-lackiert https://www.wohnfuehlidee.de/media/image/product/1/lg/dolle-tuer-und-treppengitter-pia ...

https://www.lepuitsauxlivres.com/fr/ 1.0 weekly https://www.lepuitsauxlivres.com/fr/nous-contacter 0.1 weekly https://www.lepuitsauxlivres.com/fr/ 0.1 weekly https://www.lepuitsauxlivres.com/fr/fabricants 0.7 weekly https://www.lepuitsauxlivres.com/fr/nouveaux ...