Samsung Flying Camera Phone Price, Release Date, First Look, Trailer, Featu - youtube views @drummitup1 | Camera phone, Samsung, Drone camera

SAMSUNG Micro SD 32 gb Microsdhc Endurance Video Monitoring Memory Card for HD DVR Camera Drone Carte Micro SD 32gb TF Card|micro sd 16gb|micro sd 32gbtarjeta micro sd - AliExpress

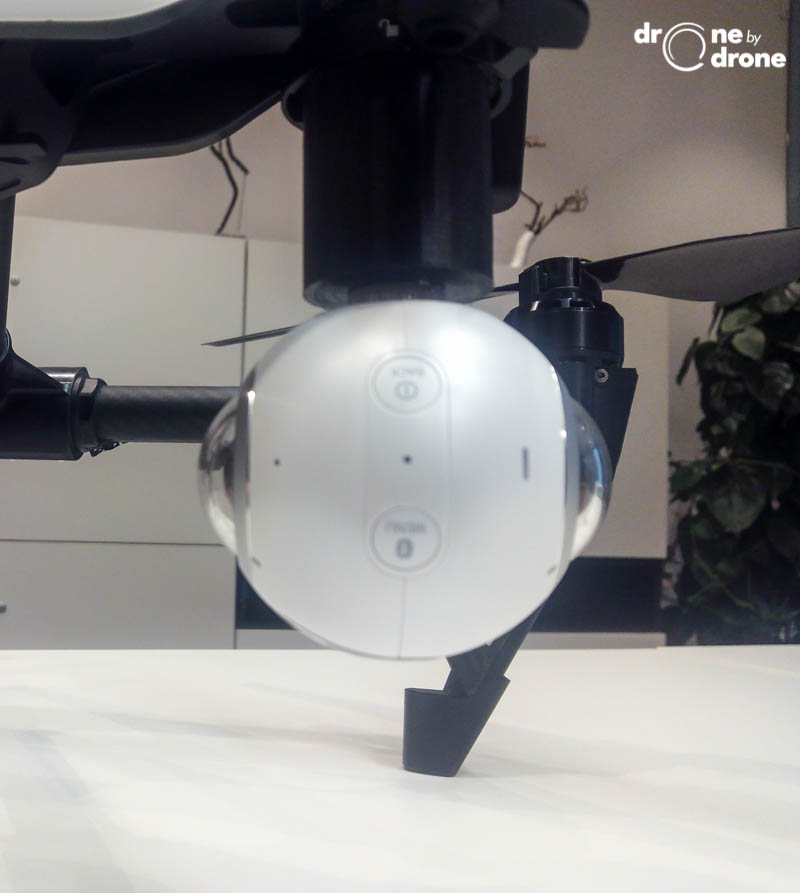

Samsung Demonstrates New Drone-Based AI Solution to Optimize 5G Network Performance - Samsung US Newsroom

dji phantom 4 pro+ quadcopter drone with 1-inch 20mp 4k camera kit with built in monitor + sandisk 64/32gb micro sdxc cards + card reader 3.0 + guards + harness + range extender + charging hub - Walmart.com

New drone rules, Covid-19 vaccine booking on WhatsApp, new launches from Samsung, Amazon, Xiaomi and more | Gadgets Now