Monster Jam™ Grave Digger™ 42118 - LEGO® Technic - Building Instructions - Customer Service - LEGO.com US

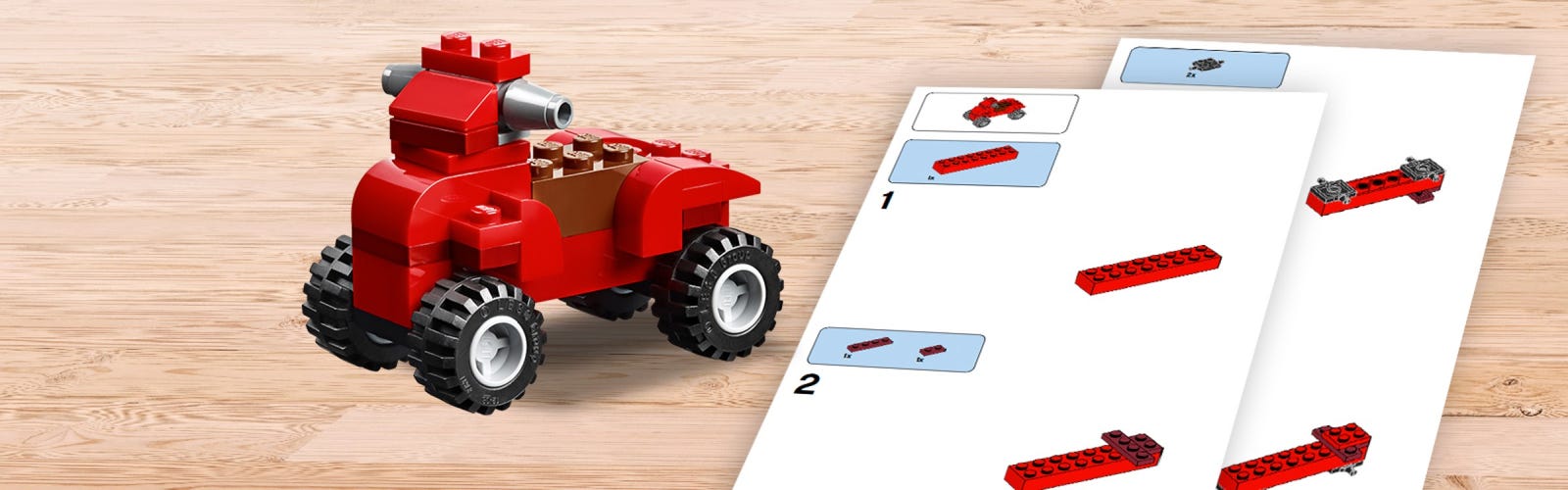

https://flic.kr/p/2dbUS8q | Mini Monster Truck Instructions | This is how you easily can build your own mini monster t… | Lego creative, Lego craft, Lego activities