Reni Large Pendant Shade in Grey and Chrome | White lamp shade, Ceiling lamp shades, Chrome floor lamps

Valosin‐containing protein ATPase activity regulates the morphogenesis of Zika virus replication organelles and virus‐induced cell death - Anton - 2021 - Cellular Microbiology - Wiley Online Library

Comparative Analysis of African and Asian Lineage-Derived Zika Virus Strains Reveals Differences in Activation of and Sensitivity to Antiviral Innate Immunity | Journal of Virology

Valosin‐containing protein ATPase activity regulates the morphogenesis of Zika virus replication organelles and virus‐induced cell death - Anton - 2021 - Cellular Microbiology - Wiley Online Library

Dramatic enhancement of superconductivity in single-crystalline nanowire arrays of Sn | Scientific Reports

Epsin but not AP‐2 supports reconstitution of endocytic clathrin‐coated vesicles - Brod - 2020 - FEBS Letters - Wiley Online Library

Networked multiple-input-multiple-output for optical wireless communication systems | Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences

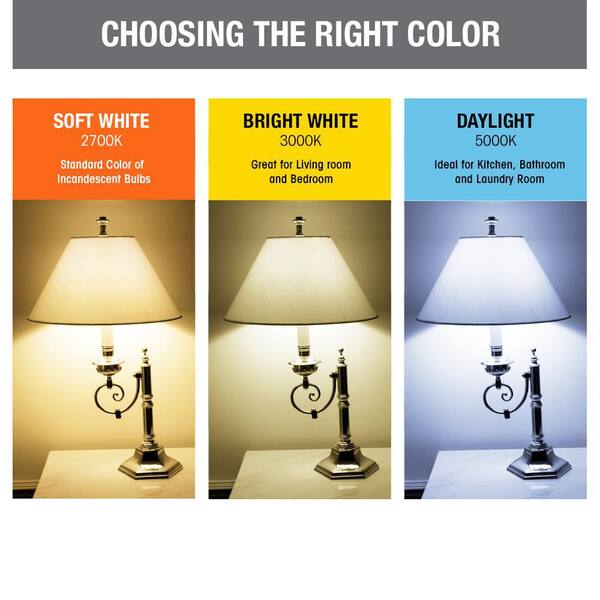

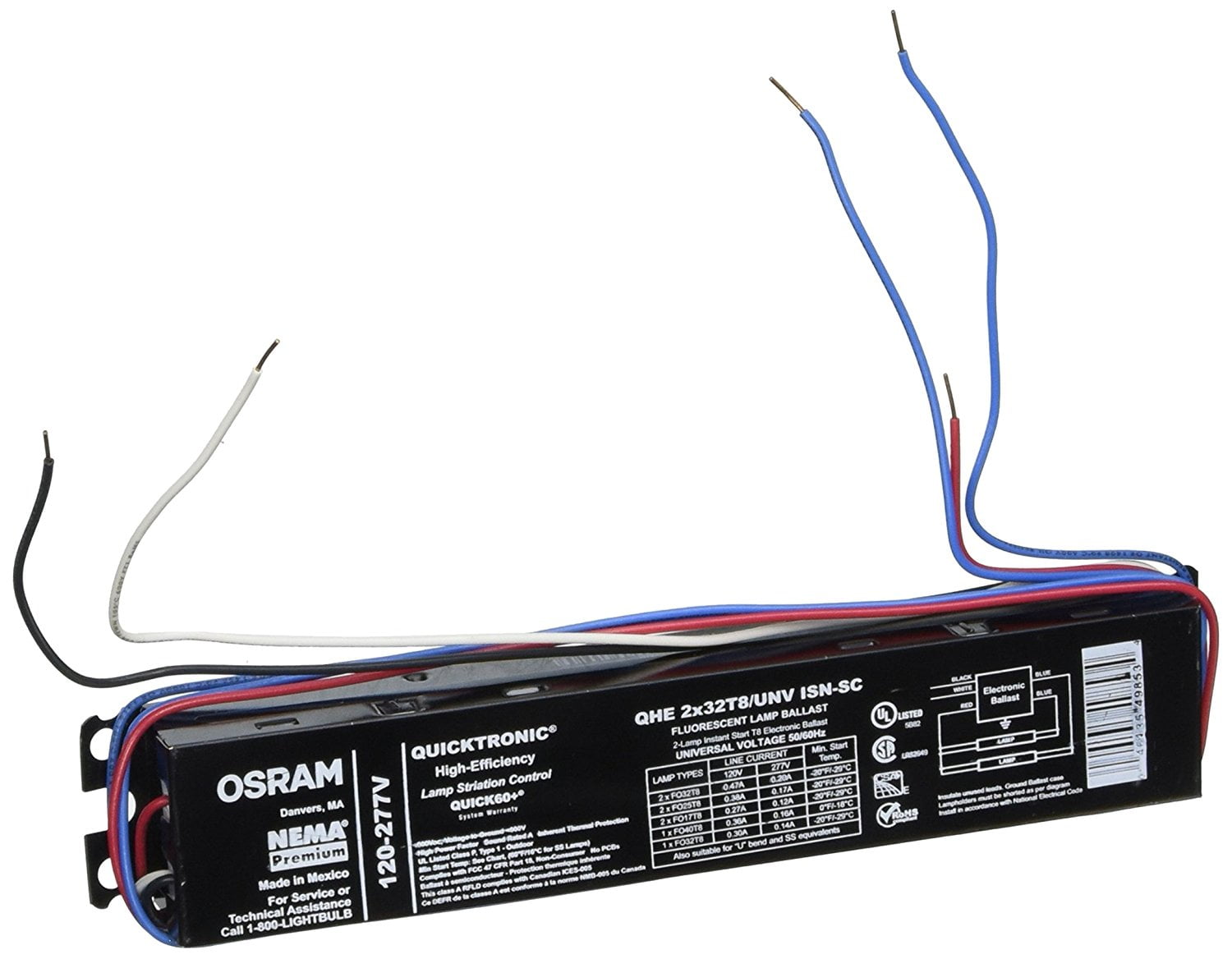

Lighting 32W T8 2-Lamp Instant Start El 49853, 2 Lamp Ballast By Sylvania - Walmart.com - Walmart.com