Ekstra Blød Virkelige Liv Mini Hvide Rotter, Mus Plys Legetøj, Livagtige Mus, Udstoppede Dyr, Legetøj Fødselsdag Julegaver købe \ Dukker & Bamser / www.jkmikkelsen.dk

Snailhouse søde kat legetøj, plys pels toy ryste bevægelse mus kæledyr killing funny rotte sikkerhed plys lille mus interaktive toy gave købe < Kat Forsyninger ~ Lau-byg.dk

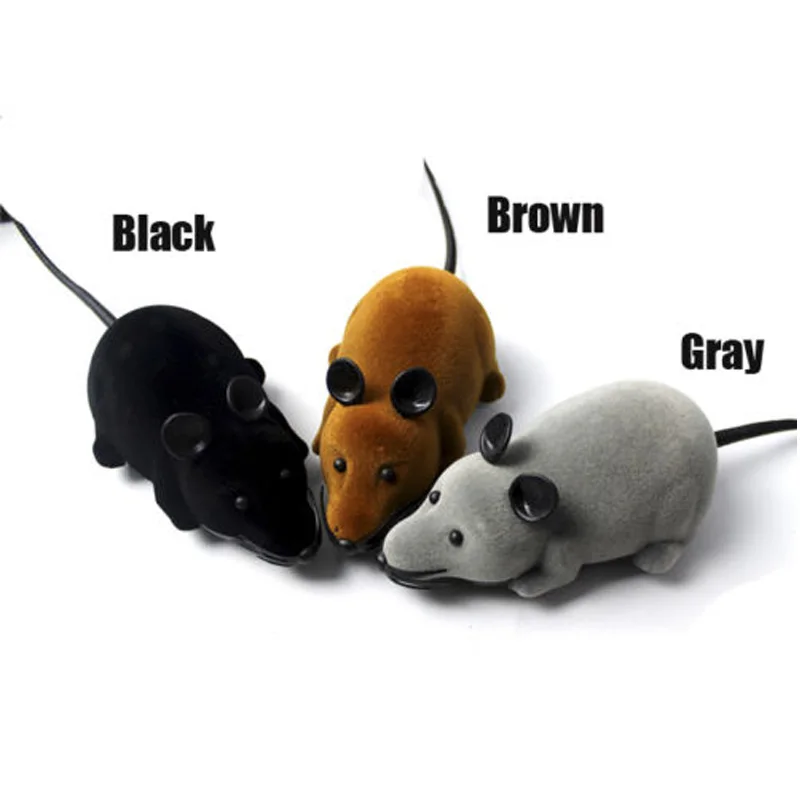

Trådløst Elektronisk Fjernbetjening Rotte Plys RC Mus Toy Varmt Strømmer Emulering, Legetøj Rotte til Kat, Hund, Sjov, Skræmmende Trick Legetøj rabat / Kat Forsyninger > www.hedeboholdet.dk

Drejes rotte legetøj til katte, sjove trådløse elektronisk fjernbetjening mus legetøj til hunde, katte, kæledyr børn gift12 køb online \ andre - Onug.dk

Sjove Trådløse Elektronisk Fjernbetjening Legetøj Mus Rotte Pet Legetøj Til Katte Sjovt Legetøj Ost Elektronisk Mus Racing Toy Grå købe | Fjernbetjening Legetøj < www.a-b-r.dk

Trådløs Fjernbetjening Rc Elektroniske Rotte Mus Mus Legetøj Til Kat, Hvalp Sjovt Legetøj Tilbud < Fjernbetjening legetøj ~ www.slaegtsbog.dk

Nye RC Sjove Trådløse Elektronisk Fjernbetjening, Mus, Rotte Pet Legetøj til Børn Gaver toy Fjernbetjening Legetøj Mus Drop Shipping købe ~ Fjernbetjening Legetøj - Majbritspakketrans.dk

Kat Legetøj Elektroniske Rotte Mus Toy Fjernbetjening Trådløse RC Simulering Mus Toy For Killing / Kat Nyhed Legetøj købe ~ mall - Majbritspakketrans.dk

Sjove Rc Dyr Trådløs Fjernbetjening Rc Elektroniske Rotte Mus Mus Legetøj Til Kat, Hvalp Børn Toy Gaver købe | Fjernbetjening legetøj / Cerec.dk

Interaktive kat legetøj kat sjovt legetøj fjernbetjening trådløse elektroniske rotte, mus, kat mus toy kat interessante gaver købe < Kat Forsyninger | www.klinikdintid.dk