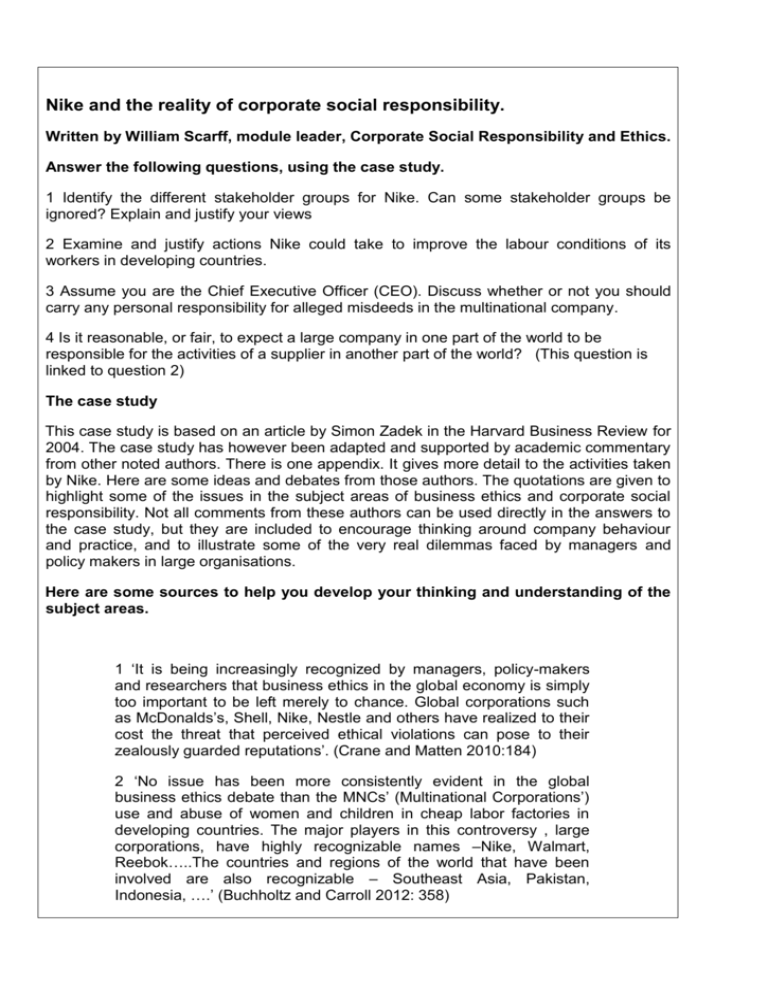

PDF) The Pragmatic and Ethical Barriers to Corporate Social Responsibility Disclosure: The Nike Case

Nike's Business Ethics. Nikes Corporate Governance would make the decision about the aims and objectives that Nike has set out. However when deciding these aims and objectives they must take into account

International business ethics (Nike).. 2 Topics Ethical issues of international business life Culture and business ethics The ethical dimensions of the. - ppt download