Buy LIVOLO Smart Touch Light SwitchNo Neutral,Zigbee Smart Wall Switch,APPVoice Control and Timer,Compatible with Alexa&Google Assistant, Glass PanelSingle-Pole,Requires LIVOLO HUB,Gold Online in Vietnam. B08PPDPH6P

Buy LIVOLO Gold Wall Touch Light Switch(No Neutral),Single Pole Touch Lamp Switch with LED Indicator,Scratch-Resistant Tempered Glass Panel,3 Gang 1 Way,VL-A803-3AG Online in Hong Kong. B08PP7X43Z

Buy LIVOLO Touch Light Switch(No Neutral),Multi Control Electronic Switch with LED Indicator,Touch Lamp Control Switch,Scratch-resistant Tempered Glass Cover,Gold,VL-A801S-3AG Online in Hong Kong. B08PNNH4CG

Livolo Gold Touch Sensor Light Switch with LED Display Light Panel made of Crystal Glass, EU Standard Switch, 1 Gang, 1 Way, VL-C701-13 : Amazon.co.uk: DIY & Tools

China Livolo EU Standard Gold Crystal Glass 2 Gang USB Charger Socket Vl-C792u-12 - China USB Socket, Livolo Socket

Livolo, Gold Crystal Glass Panel, two Gang USB Plug Socket / Wall Outlet VL C792U 13|outlet socket|socket outletlivolo wall socket - AliExpress

Buy LIVOLO Gold Wall Touch Light Switch(No Neutral),Single Pole Touch Lamp Switch with LED Indicator,Scratch-Resistant Tempered Glass Panel,3 Gang 1 Way,VL-A803-3AG Online in Taiwan. B08PP7X43Z

Livolo, Gold Crystal Glass Panel, two Gang USB Plug Socket / Wall Outlet VL C792U 13|outlet socket|socket outletlivolo wall socket - AliExpress

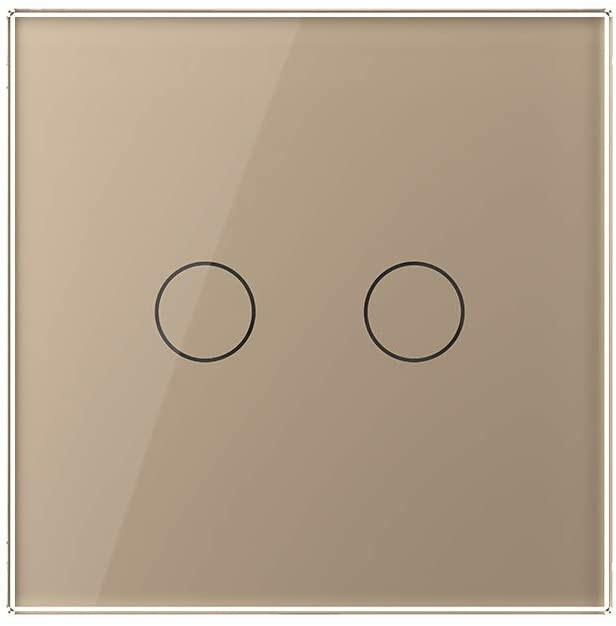

2114) LIVOLO Gold Touch Switch with LED Indicator Smart Wall Light Switch with Tempered Glass Panel UK Standard 2 Gang 1 Way Wall Switch,VL-C302-63, Furniture & Home Living, Lighting & Fans, Lighting

Livolo, Gold Crystal Glass Panel, two Gang USB Plug Socket / Wall Outlet VL C792U 13|outlet socket|socket outletlivolo wall socket - AliExpress

2114) LIVOLO Gold Touch Switch with LED Indicator Smart Wall Light Switch with Tempered Glass Panel UK Standard 2 Gang 1 Way Wall Switch,VL-C302-63, Furniture & Home Living, Lighting & Fans, Lighting

LIVOLO Gold Wall Touch Light Switch(No Neutral),Single Pole Touch Lamp Switch with LED Indicator,Scratch-Resistant Tempered Glass Panel,3 Gang 1 Way,VL-A803-3AG: Amazon.com: Tools & Home Improvement

Livolo Gold Plastic Materials EU standard Function Key For Sound Electrical Socket C7-91A-13 China Manufacturer